F

ive years ago, 620 Sixth Avenue was thriving with retail and office tenants, backed by a $421 million mortgage. However, the pandemic left it half empty and worth less than its outstanding debt. Now, Scott Rechler's RXR and Hudson Bay Capital have formed a joint partnership to acquire and recapitalize the 760,000-square-foot building, showcasing a model for rescuing assets hit hard by Covid.

RXR, which already owned half of the building, partnered with Hudson Bay Capital to secure a five-year, $320 million loan from lenders including Goldman Sachs and Blackstone. The deal gives each side a 50 percent stake in the Manhattan property. The existing debt, totaling $421 million, was consolidated this month.

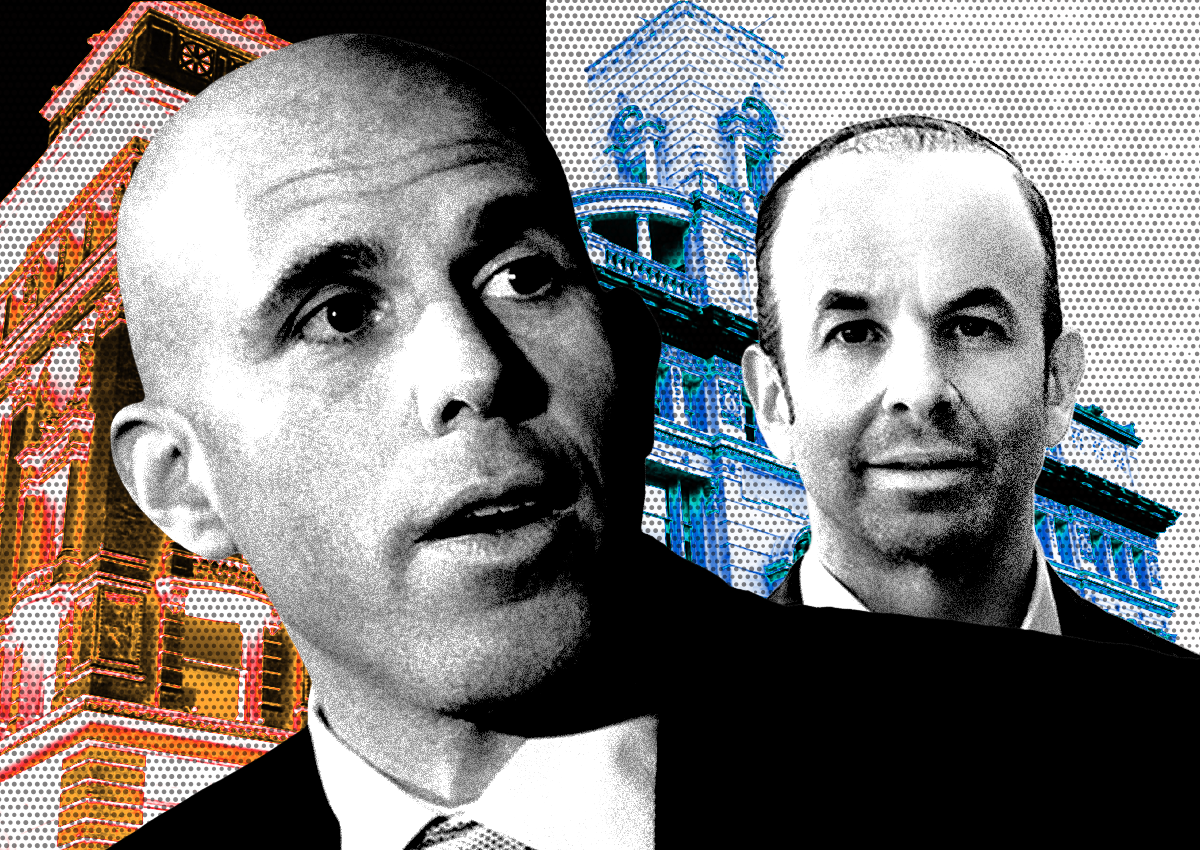

The acquisition demonstrates that iconic buildings can thrive in a post-pandemic world with the right capital structure, according to Scott Rechler, CEO of RXR. RXR has a long history with the building, which dates back to 1896 and was previously valued at $500 million. Despite occupancy dropping due to remote work and tenant bankruptcies, RXR has signed leases for 300,000 square feet in the past two years.

The building's recent deals include a renewed lease from retailer Cole Haan and a 20-year agreement with building service workers union 32BJ SEIU. The property features large windows and 100,000-square-foot floor plans, making it a desirable asset despite its challenges. Hudson Bay Capital's CEO, Sander Gerber, believes that high-quality assets paired with creative capital solutions can drive attractive returns in today's real estate market.