J

LL's Seniors Housing Capital Markets and M&A teams have arranged the recapitalization of a $725 million seniors housing portfolio spanning 20 assets across the Sunbelt, Northeast, and Midwest. The portfolio was sold to Ventas (NYSE: VTR) in an all-cash transaction, with Chicago Pacific Founders and Grace Management, Inc. as the sellers.

The properties, previously owned by CPF Living Fund I, are now managed by Grace Management. The portfolio is comprised of over two-thirds independent living units, with the balance consisting of assisted living and memory care units. Notably, the properties have undergone $49 million in renovations, boasting an average vintage of 2020.

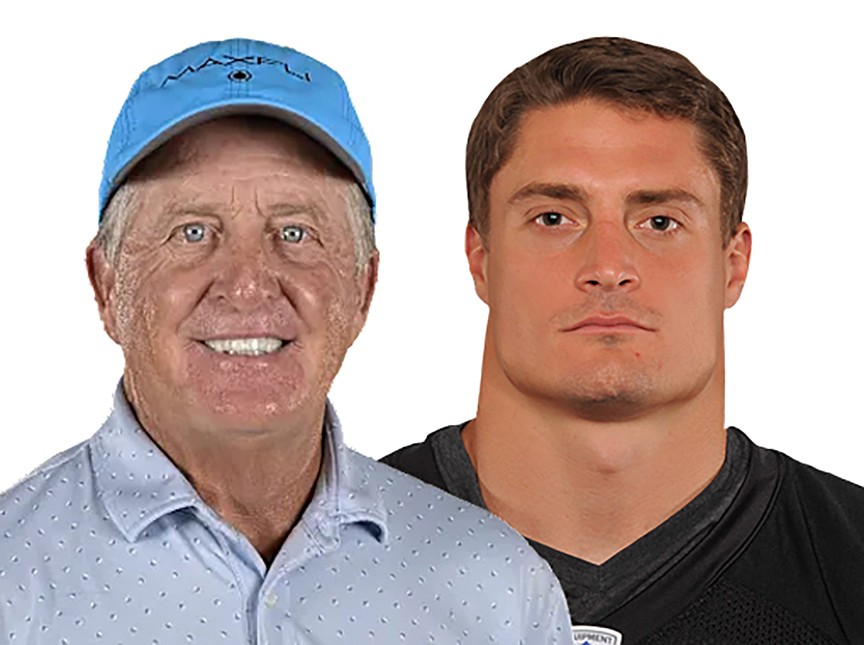

Located across 14 states, including Alabama, Arizona, Florida, Illinois, Kansas, Maine, Michigan, Nevada, New York, Ohio, Oklahoma, South Carolina, Tennessee, and Texas, the portfolio is a significant indicator of renewed investor interest in seniors housing. JLL's Seniors Housing Capital Markets team, led by Jay Wagner and Rick Swartz, represented the seller.

According to Wagner, "The appetite for scaled seniors housing portfolios is back," driven by a supply-demand imbalance caused by low recent development levels. This sets up the market for strong occupancy and margin growth over the medium-term.