K

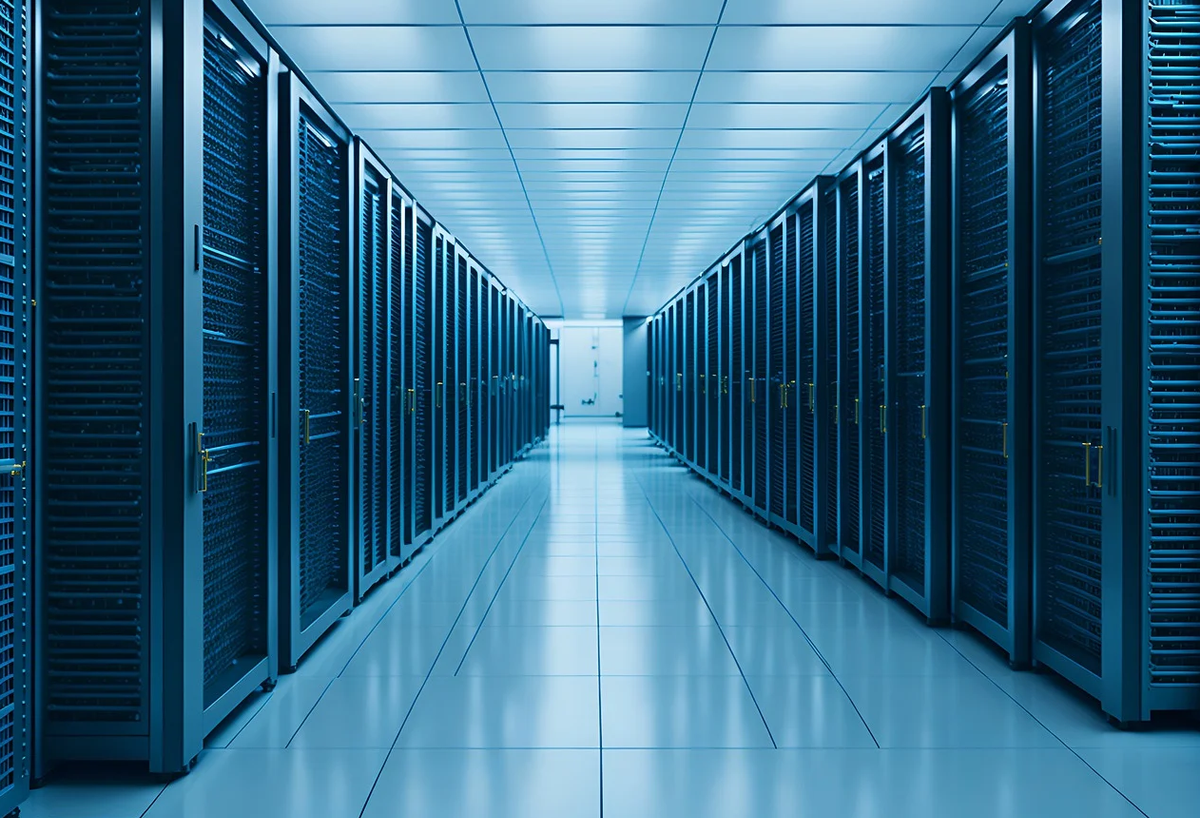

KR & Co. is consolidating its infrastructure and real estate businesses under a single umbrella, aiming to capitalize on opportunities that overlap between the two sectors. The move will enable the company to pursue investments in areas like data centers, which are increasingly in demand.

As part of the reorganization, Raj Agrawal, global head of infrastructure, will take on the role of global head of real assets, overseeing day-to-day operations for real estate. Ralph Rosenberg, current global head of real estate, will become chairman of real assets.

The combined platform will manage $157 billion in assets, including equity and credit investments. This shift reflects a growing convergence between infrastructure and real estate, driven by the need to build and power data centers, among other projects.

KKR's recent acquisition of a 19.9% stake in three power transmission companies in Ohio, Indiana, and Michigan is an example of this trend. The company plans to use these investments to build new infrastructure.

The move also highlights investors' growing recognition that real estate and infrastructure investing are complementary strategies. By combining its infrastructure and real estate businesses, KKR aims to be better positioned to capitalize on opportunities in logistics and data centers.

A spokesperson for KKR declined to comment on the matter.