T

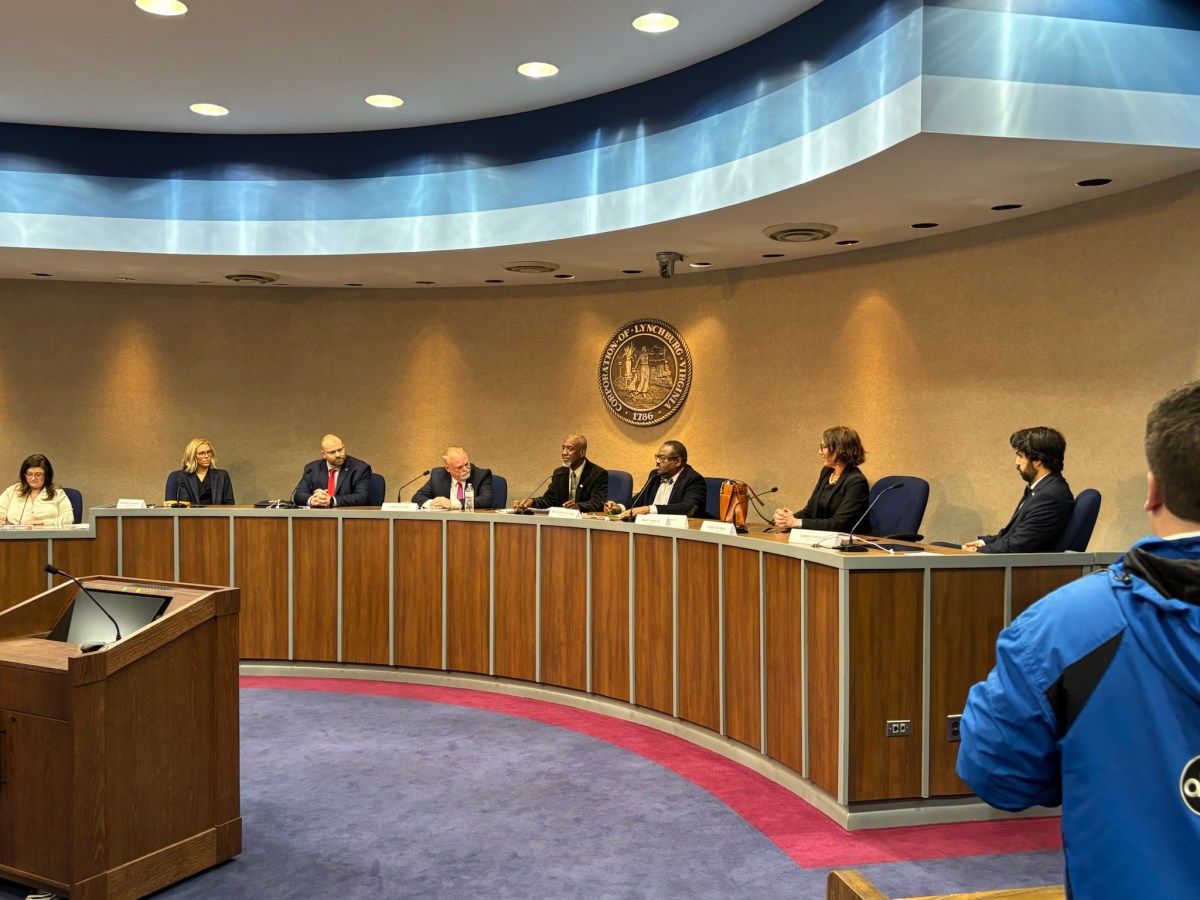

he Lynchburg City Council is set to vote on proposals that would raise the real estate tax rate while reducing or eliminating personal property taxes on vehicles. The council will meet on Monday and Tuesday to discuss these changes, as well as the city's budget for the new fiscal year.

To keep tax bills stable after a 20% increase in real estate values, the council could lower the tax rate from 89 cents per $100 of value to 76.7 cents. However, due to planned growth in the city's budget, the council voted to propose raising the real estate tax rate to $1.025 per $100 of value while eliminating vehicle taxes for many residents.

The proposed personal property tax changes would exempt the first $20,000 of a vehicle's assessed value from taxation and lower the tax rate on personal vehicles to $1.30 per $100 of value by 2026. This change is projected to decrease income by $14 million, but the city expects to receive about $7 million in personal property tax income during the second half of 2025.

The council will also consider changes to its rules of procedure on Tuesday, including allowing residents to speak before non-residents during public comment periods and restricting interactions between council members and the public. On Tuesday evening, the council will vote on setting the city budget for the new fiscal year and proposed water and sewer rate increases.

The total general fund budget is approximately $254.9 million, with a plan to balance it by using about $9 million from the city's existing fund balance. The utility rate proposals include increasing the water rate from $3.29 to $3.45 per hundred cubic feet of water used, and changing the monthly stormwater charge for single-family units from $4.93 to $5.15.