L

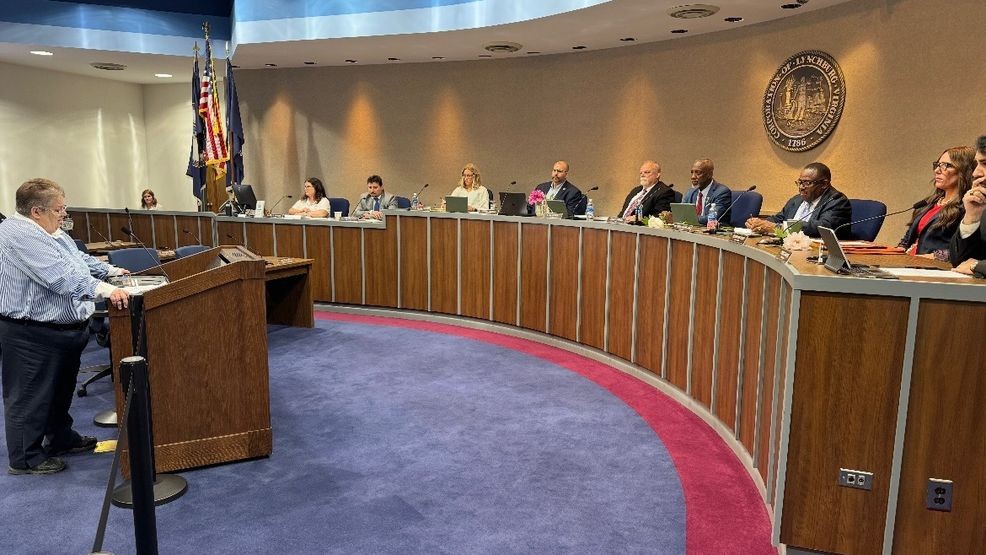

YNCHBURG, Va. - The Lynchburg City Council failed to set a real estate tax rate during their seven-hour meeting on Tuesday night. Councilman Martin Misjuns emphasized the need for a clear decision on taxes, stating "We need to show our citizens what we're going to do. Are we going to increase taxes or are we not?"

The city's current budget is based on an 89-cent tax rate per $100 of assessed value. Some council members want to lower this rate to 76.7 cents, which was proposed by Councilman Chris Faraldi. The proposal passed in a 4-3 vote, but not without controversy.

Councilwoman Stephanie Reed expressed concerns about making a decision without seeing the budget's impact. "You need to see it before we make a decision that could have negative impacts for long term." The council will discuss the rate at their next work session and must finalize the budget by June 30.

A heated exchange occurred between Councilman Misjuns and City Manager Wynter Benda, with Misjuns accusing staff of withholding financial documents. Benda denied these allegations, stating "We have tried our best to give you the best information across the board, timely, expediently and fully."

The difference between keeping the current rate and changing it to an equalized rate is over $11 million.