T

he Manhattan office market showed signs of recovery, with high-end properties leading the way. A record number of triple-digit leases were signed last year, with 28 deals exceeding $200 per square foot. This surpassed previous records, according to JLL's "Analysis of Top Tier Transactions" report. The total number of leases over $100 per square foot also reached a new high, spanning 9.8 million square feet and outpacing previous years.

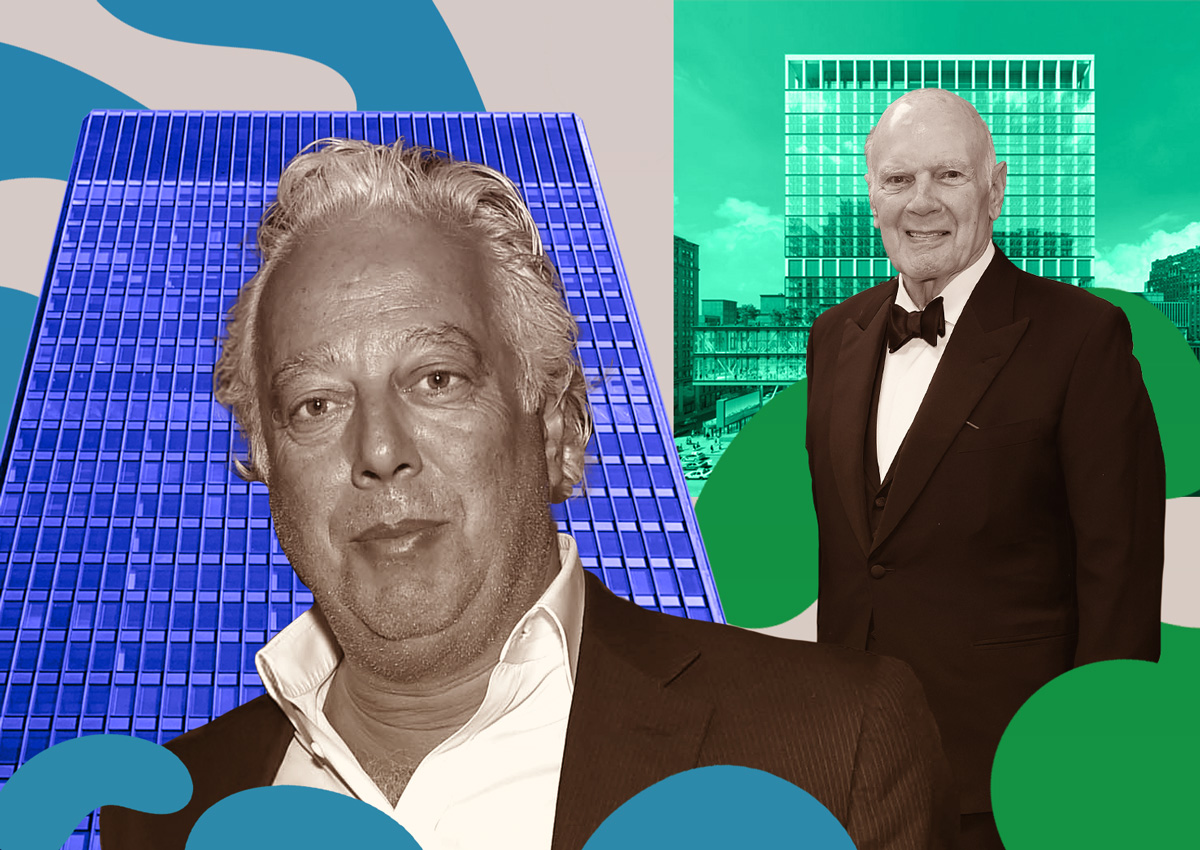

Large financial service firms dominated the market, accounting for 40% of all leases signed in Manhattan last year and nearly two-thirds of triple-digit deals. Notable landlords like RFR Holdings' Seagram Building and Steve Roth's Vornado Realty Trust secured multiple high-end leases. The vacancy rate remains high at 18%, but tenants signed a record-breaking 30.2 million square feet of space, the first time this threshold has been reached since 2018.