S

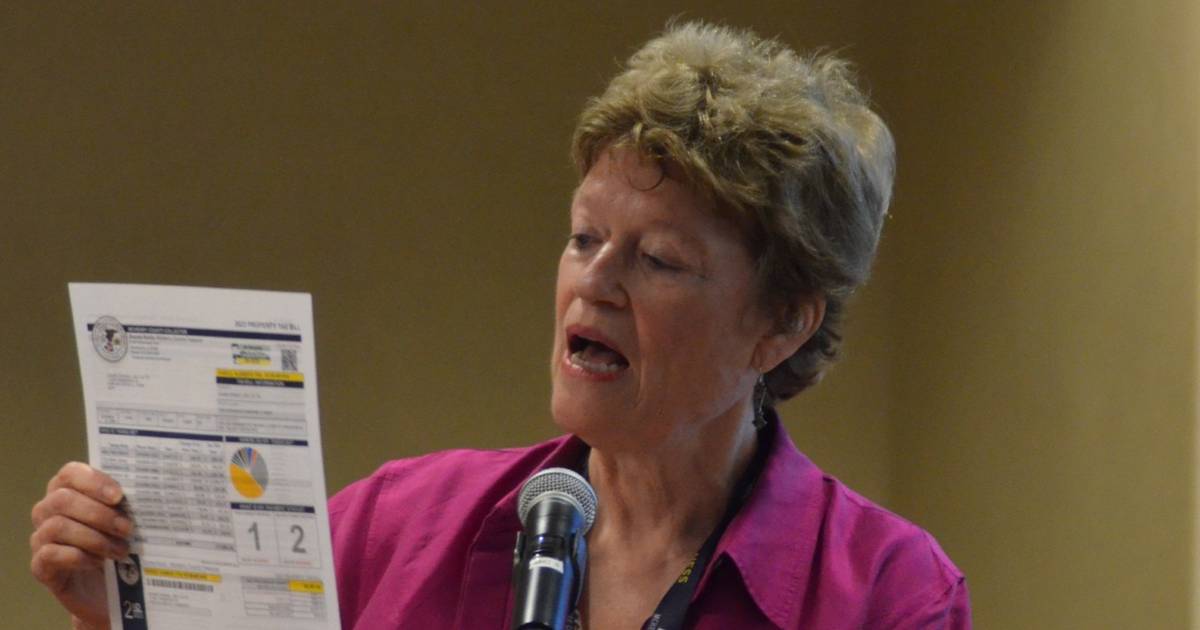

eniors can enroll in McHenry County’s Real‑Estate Tax Deferral program beginning January 1, as announced by Treasurer Donna Kurtz. The program offers a loan of up to $7,500 to cover a senior’s property‑tax bill. Eligibility now extends to households earning up to $75,000—an increase from the former $65,000 threshold—and the interest rate has been cut from 6 % to 3 %.

To qualify, applicants must be at least 65 years old by June 1, have a total income below $75,000, and meet the following criteria:

• Reside on the qualifying property for the past three years.

• Own equity in the property.

• Have no outstanding property taxes or foreclosures.

• Maintain fire and casualty insurance.

Once approved, a lien for the deferred amount will be recorded against the property. The loan is repaid when the property is sold, transferred, or within one year after the owner’s death.

Applications are accepted through the treasurer’s website (treasurer.mchenrycountyil.gov) and must be submitted by March 1; no extensions will be granted. “The income increase allows more seniors to benefit from this cost‑effective way to defer taxes and free up funds for other needs,” Kurtz said.

For additional information or to apply, call the treasurer’s office at 815‑334‑4260 (calls after hours are returned the next business day) or email [email protected]. Seniors are also encouraged to explore other tax‑exemption options; contact the McHenry County Assessments Office at 815‑334‑4290 or [email protected] for details.