M

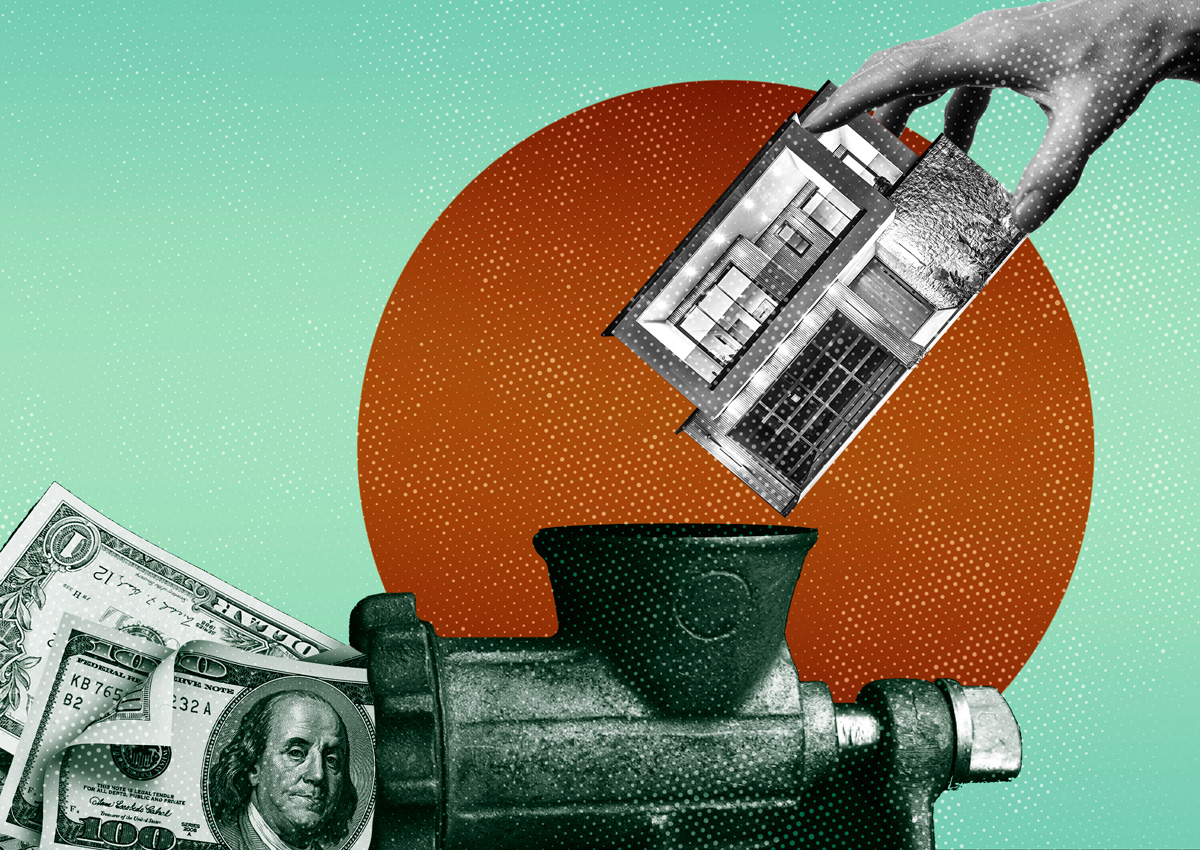

easure ULA's nickname "mansion tax" may be justified, as single-family residential transactions account for the majority of revenue generated so far. In September, residential sales brought in $11.6 million, or 59% of the total, according to the Los Angeles Housing Department. This trend has held since April, with residential sales accounting for nearly 39% of total funds raised to date.

Currently, ULA imposes a 4% tax on properties sold for $5.15 million or more within the city of Los Angeles, and a 5.5% tax on deals over $10.3 million. Commercial transactions lagged behind in September, generating only $4.5 million across four deals. Since Measure ULA's start, commercial deals have generated $112.4 million from 126 transactions.

The highest number of transactions since implementation occurred in ZIP codes 90272 (Pacific Palisades) and 90049 (Bel-Air and Brentwood). Voters approved Measure ULA in November 2022 to fund affordable housing, homeless prevention, and tenant assistance programs, but the program has missed its initial revenue estimates. A report released in April praised ULA as "effective in improving housing conditions" in the city.

Real estate agents have reported a cooling of sales activity due to the tax, with some deals shifting to cities outside Los Angeles to avoid the issue. Brokers say some sellers are accepting that the tax is not going away and are adjusting their strategies accordingly. The tax's business implications beyond real estate, including its impact on industries like title and escrow companies, remain unexplored.