S

T. CHARLES, Mo. – A new state law could trim your taxes but may strain local services. Senate Bill 3, originally meant to fund the Kansas City Chiefs and Royals stadiums, contains a provision that would freeze property taxes in certain Missouri counties, including St. Charles, Jefferson, and Franklin. GOP state representative Joe Nicola championed the freeze during the June special session, and the bill passed, setting the stage for a tax‑credit proposal on the 2026 ballot.

On Monday, the St. Charles County Council moved the freeze question to voters, requiring residents to decide whether to lock in current real‑estate tax rates. Jefferson and Franklin counties are expected to face similar ballots. St. Charles County Collector Michelle McBride warned that while the county might absorb a modest loss, smaller counties could see a sharp hit to their budgets. “They would have nothing to fund their public services,” she said.

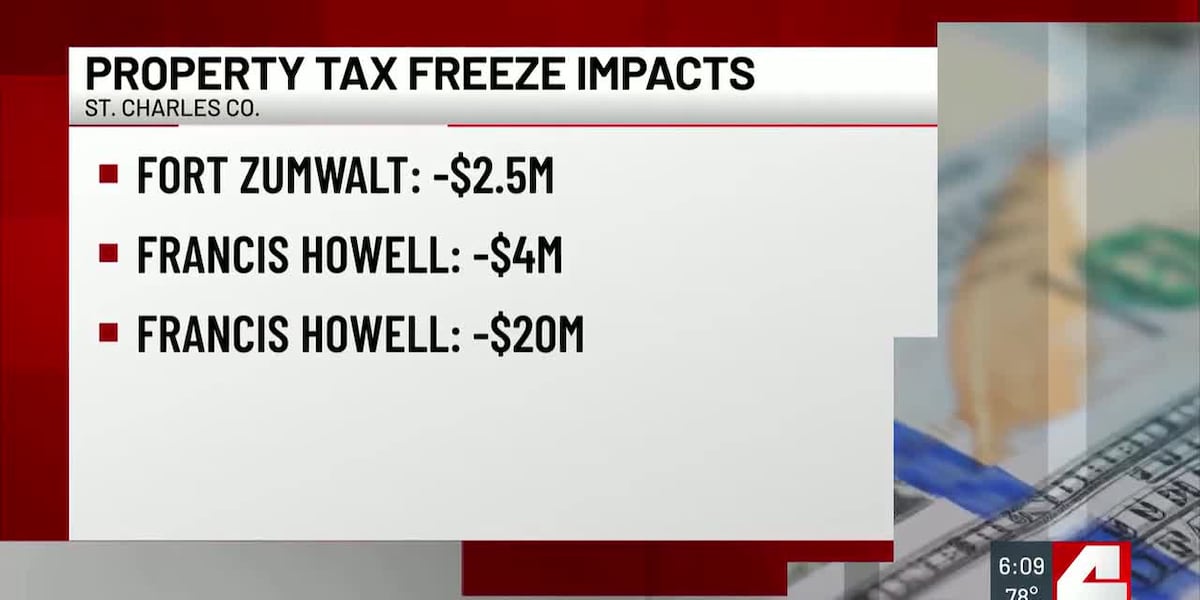

School districts are already feeling the pressure. Fort Zumwalt Superintendent Henry St. Pierre forecasts a $2.5 million deficit for the 2026‑27 year, while Francis Howell anticipates a $4 million shortfall that could grow to $20 million in five years. McBride noted that rising class sizes could erode educational quality. Fire and ambulance services are also at risk; the St. Charles County Ambulance District estimates a one‑year loss of $1.6 million, with a ten‑year shortfall exceeding $30 million. In Marshfield, Fire Chief Michael Taylor warned that the organization could not survive without additional funding.

Several districts, including the City of St. Charles School District, have signaled intent to sue, claiming the law is unconstitutional, though no lawsuit has yet been filed. Supporters remain strong. St. Charles County Executive Steve Ehlmann argues that residents have demanded a tax break and deserve it. He also called for inclusion of St. Louis City and County in the freeze, stating, “Not only the people in St. Charles, Jefferson, Warren & Lincoln Counties, I think the people in St. Louis City and County deserve a chance too.”

The law’s impact remains uncertain, but voters will decide in April 2026 whether to lock in property taxes or risk funding cuts for schools, fire, and ambulance services.