M

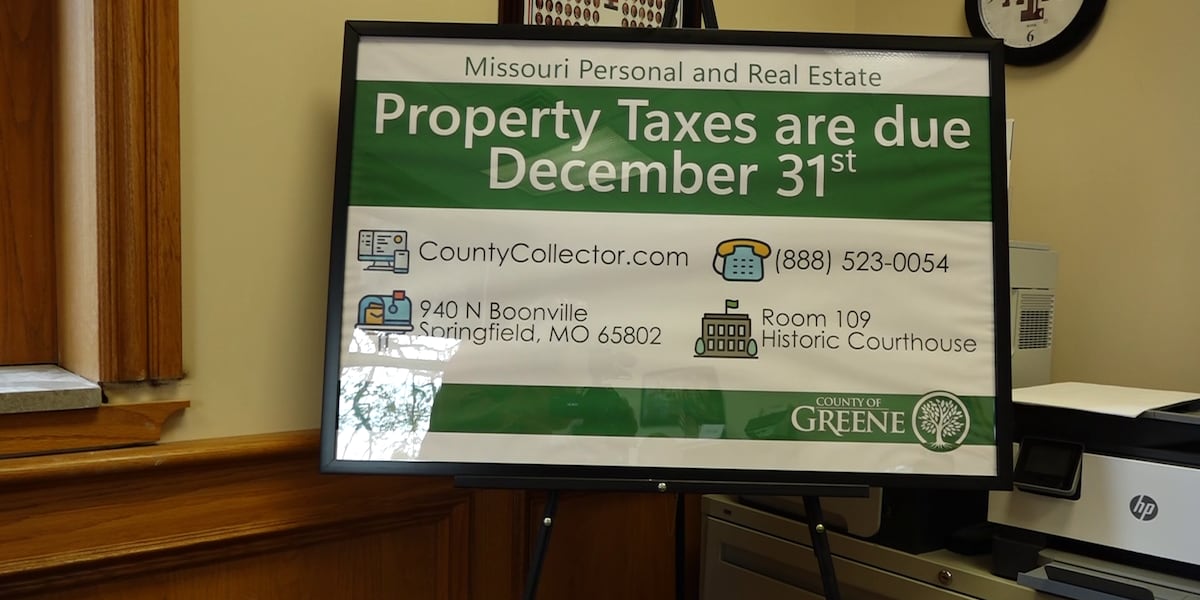

issouri's real estate and personal property taxes are now open for payment, with a deadline of December 31. According to Allen Icet, Greene County Collector, both types of taxes must be paid between November 1 and the end of the year. If payments aren't received by December 31, penalties and interest will be applied.

Property taxes cover various expenses, including schools, fire districts, and library districts. Taxpayers can expect to receive their statements in the mail or online soon, with hard copies available by late November. Icet advises those who haven't received their statement by Thanksgiving to contact the office.

Taxpayers have multiple payment options, including online, in-person, mail, and phone payments. However, if taxes aren't paid by December 31, a penalty of around 11% will be added to the bill. This includes a 10% penalty and 2% interest charge. Icet encourages taxpayers to make timely payments to avoid these additional fees.

Before making a payment, it's best to contact your collector to confirm their office is ready to accept payments.