M

ontana's property tax system is notoriously complex, involving intricate math and a multitude of rules to fairly distribute the cost of public services like schools and police departments among hundreds of thousands of properties.

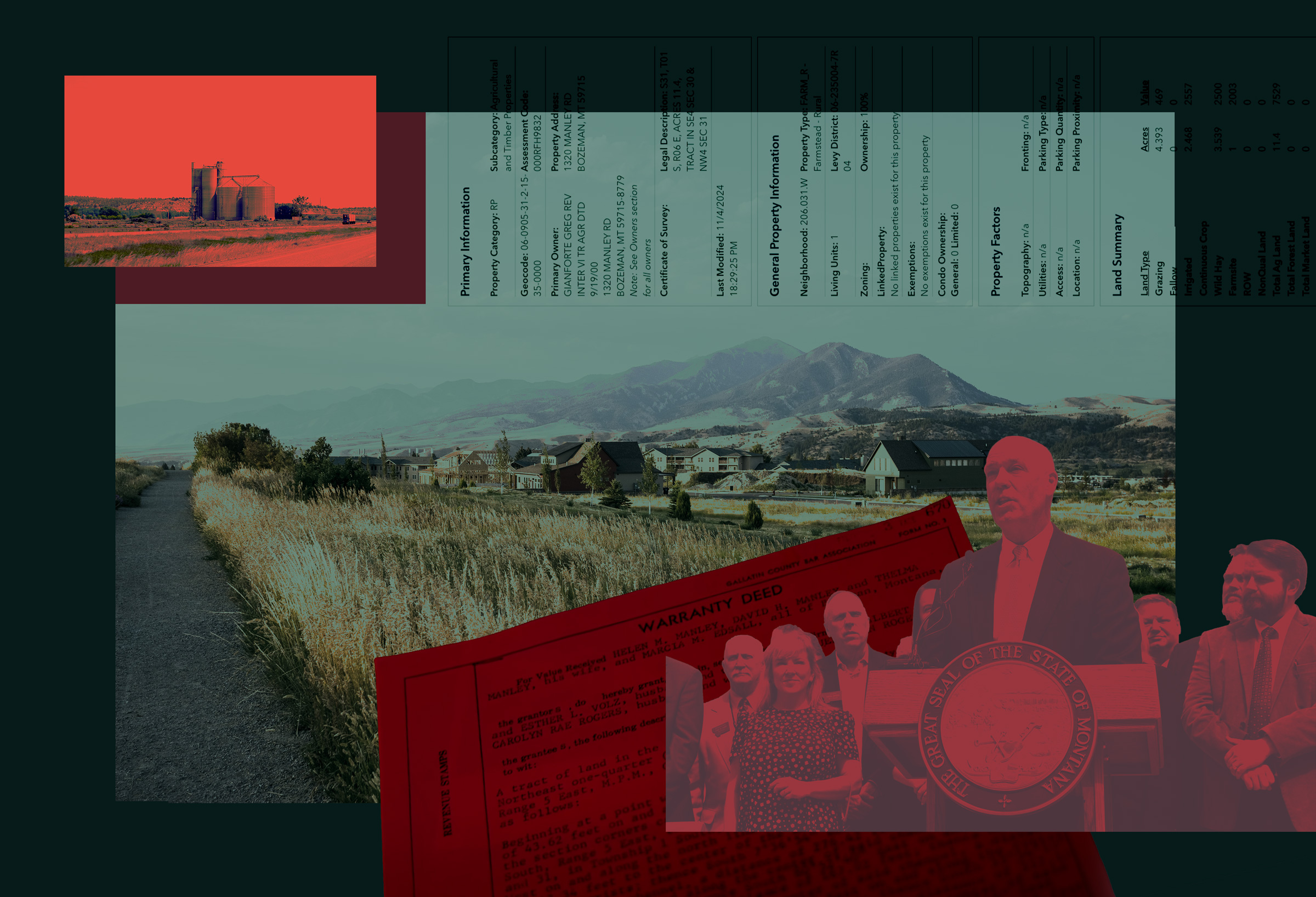

The concept of fairness when it comes to taxes is subjective, making it challenging for lawmakers to craft a fair framework without loopholes. A recent investigation by High Country News and Montana Free Press shed light on a long-standing concern in Montana politics: whether a property tax break intended for farms and ranches is being exploited by luxury home owners in rural areas.

The agricultural tax status offers farm and ranch properties a discount relative to residential properties by valuing the underlying land at its production value, rather than market value. This results in significant tax savings, with some properties paying as little as $6.61 per acre in land taxes compared to $1,609 for residential parcels of similar size.

Critics argue that it's too easy for high-end real estate to qualify for agricultural tax benefits, particularly since larger Montana properties automatically qualify without being required to demonstrate farm or ranch activity. Smaller properties can also qualify by reporting minimal agricultural income, which has not been updated since 1986.

Thousands of million-dollar homes in Montana are benefiting from the ag tax treatment, including Governor Greg Gianforte's Bozeman home. An analysis of state property data found over 3,000 properties with million-dollar structure values that qualify for full or partial agricultural tax benefits, resulting in stark tax disparities between adjacent residential and agricultural properties.

Lawmakers could address these concerns by revising the tax code during this year's Montana Legislature session. Two bills under consideration aim to tighten qualification standards and increase taxes on homesite portions of high-value ag properties. However, similar measures have previously stalled due to opposition from those who would face higher tax bills.