O

n April 8, 2024, millions of Americans briefly left their homes, schools, and workplaces to witness the Great North American Eclipse. This rare event marked a turning point for national commercial real estate in 2024, as the industry finally began to shake off the high interest rates that had plagued it since 2022. The eclipse became a metaphor for the industry's transition from a period of uncertainty to one of renewed optimism.

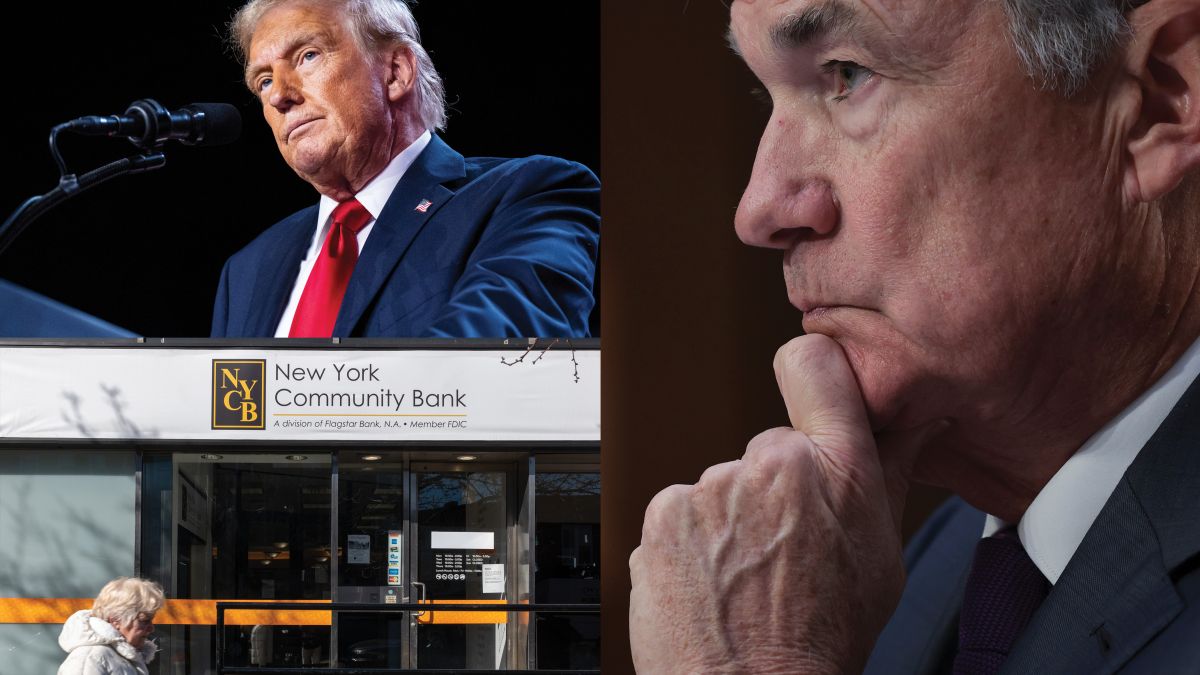

As the year progressed, capital stacks remained out of balance due to persistently high interest rates, which left capital markets impaired and both borrowers and lenders in need of time, money, and luck to navigate unfavorable macroeconomic factors. The 10-year Treasury note fluctuated throughout the year, opening at 3.9 percent, rising to 4.7 percent in late April, falling to 3.6 percent in mid-September, and ticking back up to 4.4 percent following the election.

The number of CRE investment sales declined by 4.7 percent year-over-year nationwide in the first three quarters of 2024, with a 33 percent drop compared to the average from 2017 to 2019. However, the industry showed surprising consistency, with no extreme highs or lows. "It was a fine year," said Michael Gigliotti, senior managing director at JLL. "It wasn't an awful year, but in a year marked by lots of volatility and a lot of things going on in the world, there was a surprising amount of consistency in the real estate world."

The CRE industry faced significant challenges in 2024, including high interest rates, impaired capital markets, and uncertainty surrounding the election. However, alternative lenders emerged as a permanent fixture in the CRE financial system, providing much-needed capital to borrowers and sponsors. "We're having conversations with banks on a daily basis about being a financing partner so they can serve their clients," said Scott Rechler, chairman and CEO of RXR.

The office sector saw renewed activity in 2024, driven by employers issuing return-to-work mandates and signing big leases. Manhattan office leasing exceeded 30 million square feet in November, hitting that threshold for the first time since 2019. The industrial sector also showed strength, with national vacancies standing at 7 percent through the first nine months of the year, but rents rising by 7.1 percent between September 2023 and September 2024.

Data centers emerged as a bright spot in 2024, receiving billions of dollars in fresh capital in anticipation of continued growth in artificial intelligence, cloud computing, and the merging of the internet with the economy. Between now and 2028, global investment in new data center capacity is expected to reach $2.2 trillion.

The Trump bump had a significant impact on CRE in 2024, as his policy agenda raised concerns about inflation and deficit spending. However, despite these challenges, capital remains king in CRE, with many investors ready to make deals. "There's so much money on the sidelines," said Franz Colloredo-Mansfeld, chairman and CEO of Cabot Properties. "There's a general sense in the commercial real estate world that we've come through the worst of it and that people are ready to make deals."