A

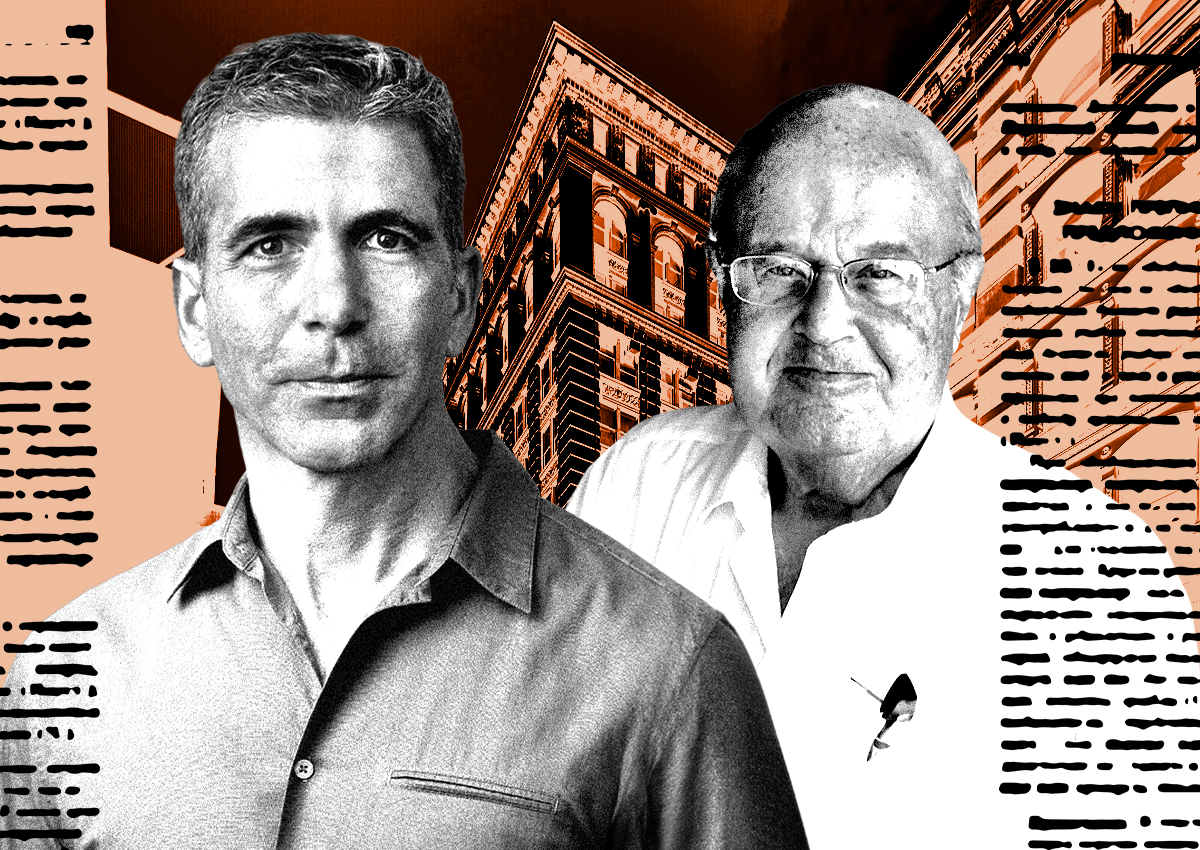

$200 million loan tied to the Prince Building, a 12-story Soho property, has defaulted after its sponsors failed to repay the debt at maturity. This marks a second near-miss for Eric Hader of Allied Partners and Stanley Cayre of Midtown Equities, who had previously navigated a similar crisis two years ago by buying time through special servicing. However, despite their efforts, occupancy rates remained low and cash flow barely covered mortgage payments as of June 2024.

The Prince Building's struggles are not unique; many office owners have received short-term extensions from special servicers in the hopes that interest rates would drop or they could improve property performance enough to refinance. Although rates have declined by 75 basis points since their peak, this hasn't helped properties with poor fundamentals like the Prince Building, which features outdated lofted floors and has seen its value decline by 25% since 2012.

Industry experts warn that lenders may now be less willing to extend further credit, especially if property values continue to sink. "As the rate cuts come through and you're an office property that still can't refinance, then the special servicers realize the rate cuts are here, it's not helping you, now we need to foreclose," said one expert.