R

eal estate investment trust Prologis has continued to refine its portfolio by selling two warehouses in Chicago's southwest suburbs. The San Francisco-based company, which focuses on industrial properties, divested the assets as part of its strategy to recycle capital into new investments and acquisitions. Cushman & Wakefield represented Prologis in the transactions.

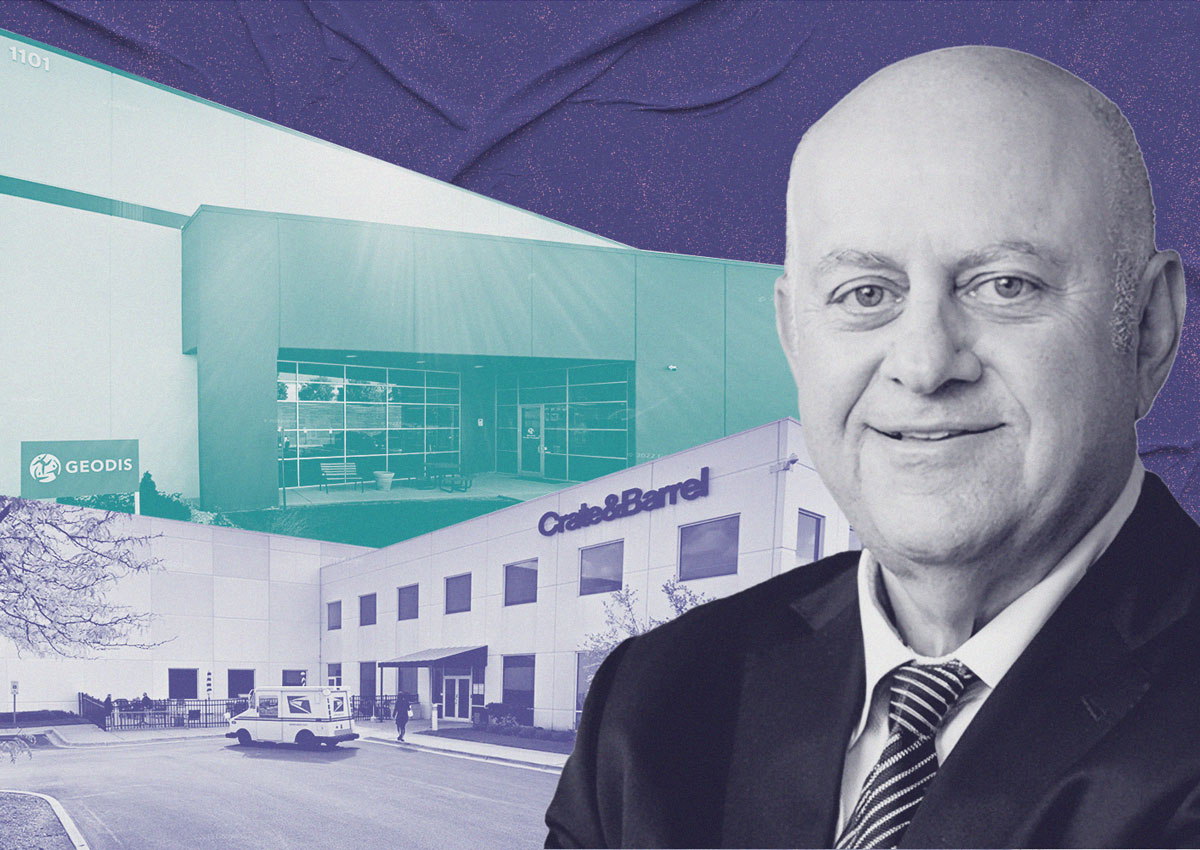

Denver-based Amstar Group acquired the properties for a combined $106.5 million, marking two of the largest single-property deals in the region this year. The Naperville warehouse, spanning 829,000 square feet, was purchased for $54.4 million and is fully leased to Crate & Barrel. The Romeoville warehouse, with 541,000 square feet, fetched $52.1 million and is primarily occupied by logistics firm Geodis.

The sales are notable given the current limited deal flow in Chicago's industrial real estate market. Industrial property sales in the region have totaled $2.3 billion so far this year, down from $3.3 billion last year and $6.9 billion in 2022. Prologis still holds over 30 industrial properties in the Chicago area, including several near O'Hare International Airport.

The company's decision to sell these assets comes after it raised its financial outlook in July, citing strong nationwide demand for its properties. This is not the first time Prologis has sold off non-strategic assets; earlier this year, it sold 20 properties in Minnesota's Twin Cities to EQT Group.