P

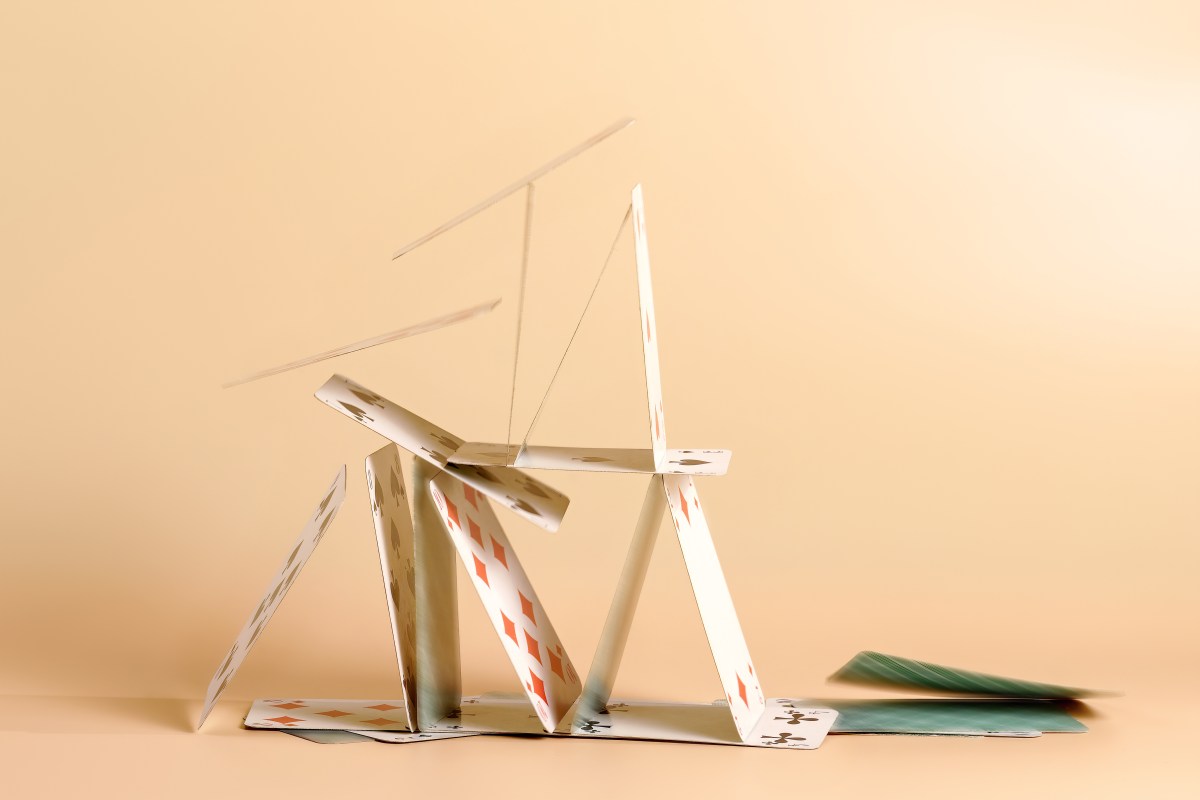

roptech startups born during the low-interest-rate era are struggling to stay afloat. Investments in U.S.-based real estate startups plummeted from $11.1 billion in 2021 to $3.7 billion last year, according to PitchBook data. This has led some companies to sell off or shut down.

Two recent examples include Divvy Homes and EasyKnock. Rent-to-own startup Divvy is being acquired by Maymont Homes, a division of Brookfield Properties. EasyKnock, which offered sale-leaseback models, abruptly closed its doors due to lawsuits and an FTC consumer alert.

Divvy's acquisition isn't entirely surprising, as the company had been laying off staff since 2022 and conducted three rounds of layoffs in one year. Despite raising over $700 million from investors like Tiger Global Management and Andreessen Horowitz, Divvy's valuation dropped significantly from $2.3 billion to $2 billion.

EasyKnock's demise was also due to high interest rates, which made it difficult for the company to finance its operations. The startup had taken on debt to buy homes and rent them back to homeowners, but this model attracted controversy and lawsuits. EasyKnock was reportedly insolvent when it shut down, overwhelmed by debt.

The struggles of Divvy and EasyKnock are a sign of a larger trend in real estate fintech. With interest rates still high and funding difficult to come by, more proptech startups may face similar challenges in the coming months.