A

t a time when the real estate industry is grappling with low-housing supply, high inflation, and rising mortgage rates, IMN Panelist Speaker John M. Laviter sounded a warning at the 12th annual single-family rental conference in Scottsdale, Arizona. He cautioned that current asset values are on the cusp of change, but not for the better.

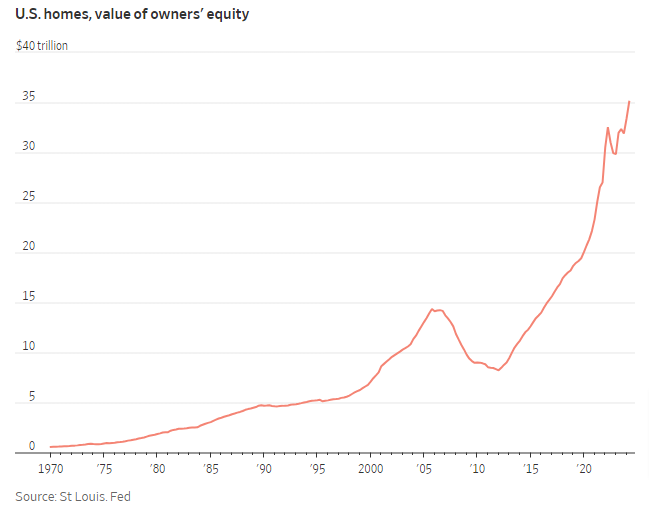

Laviter urged real estate professionals to heed the signs of another potential market crash, similar to the one in 2008. "We've been spoiled by trending inflation," he said, noting that it's been over 16 years since a genuine recession. The Producer Price Index and Personal Consumption Expenditure Index have shown significant double-digit increases, while U.S. home values and owners' equity have surged.

"If you think this is normal, think again," Laviter warned, citing recent readings indicating continued pricing pressures. He suggested that a sustained pullback in consumer spending or global economic instability could lead to the feared "hard landing." Some economists speculate that factors such as trade changes, world wars, and global inter-dependence could alter the economy's trajectory.

Laviter expressed concern about the potential impact of recent economic instability in China, particularly with higher tariffs. He noted that history shows a worse situation stemming from deflation than inflation, referencing the Great Depression when prices fell by over 20% between 1930 and 1933.

While many recession indicators have shown signs in recent years, including an inverted yield curve and decreasing money supply, Laviter sees opportunity in the real estate market during economic decline. He recently announced commitments to fund a $2 billion Real Estate Investment Trust (REIT) with Kunz Investments, Inc., a venture capital group from California.