V

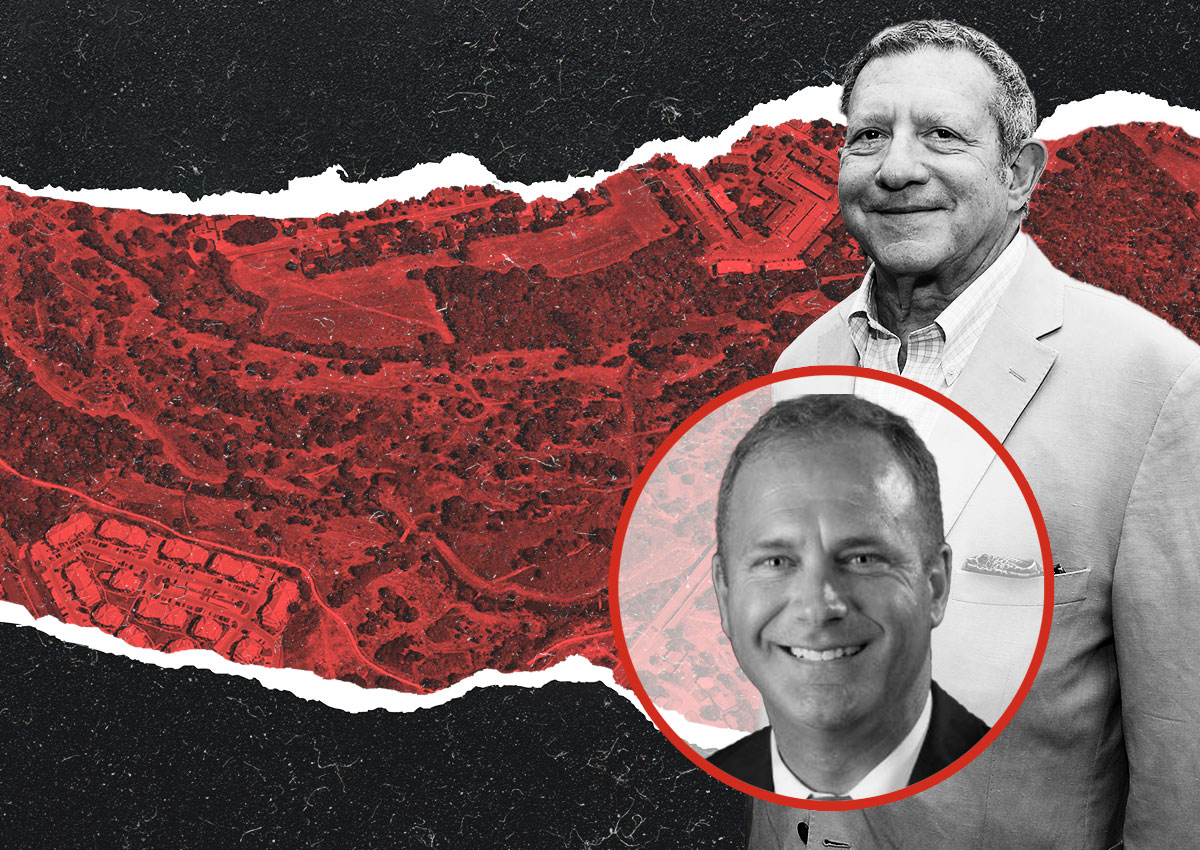

alor Club Partners, the California-based developer behind a planned veteran-focused community in Central Texas, is at risk of losing its 50-acre property. A court-appointed receiver has moved to foreclose on the land, which was acquired by Valor Club in 2018 for a $7 million loan from Pride of Austin High Yield Fund 1. However, the fund's value has plummeted due to alleged fraudulent practices, leaving few assets and prompting its receiver to pursue foreclosure.

This is not the first time Valor Club has faced financial difficulties; last year, it lost another 160 acres meant for the same development after defaulting on a loan from an unidentified lender. Negotiations are underway to avoid the current foreclosure, but the land remains undeveloped, awaiting either a resolution or ownership change that could determine its future.

The community, envisioned as a master-planned development with homes, job training, and recreation tailored to military personnel and their families, has been in the works for over a decade. Plans included a handicap-accessible golf course, hotel, event center, BMX racetrack, and mental health services to support veterans' transition to civilian life.