R

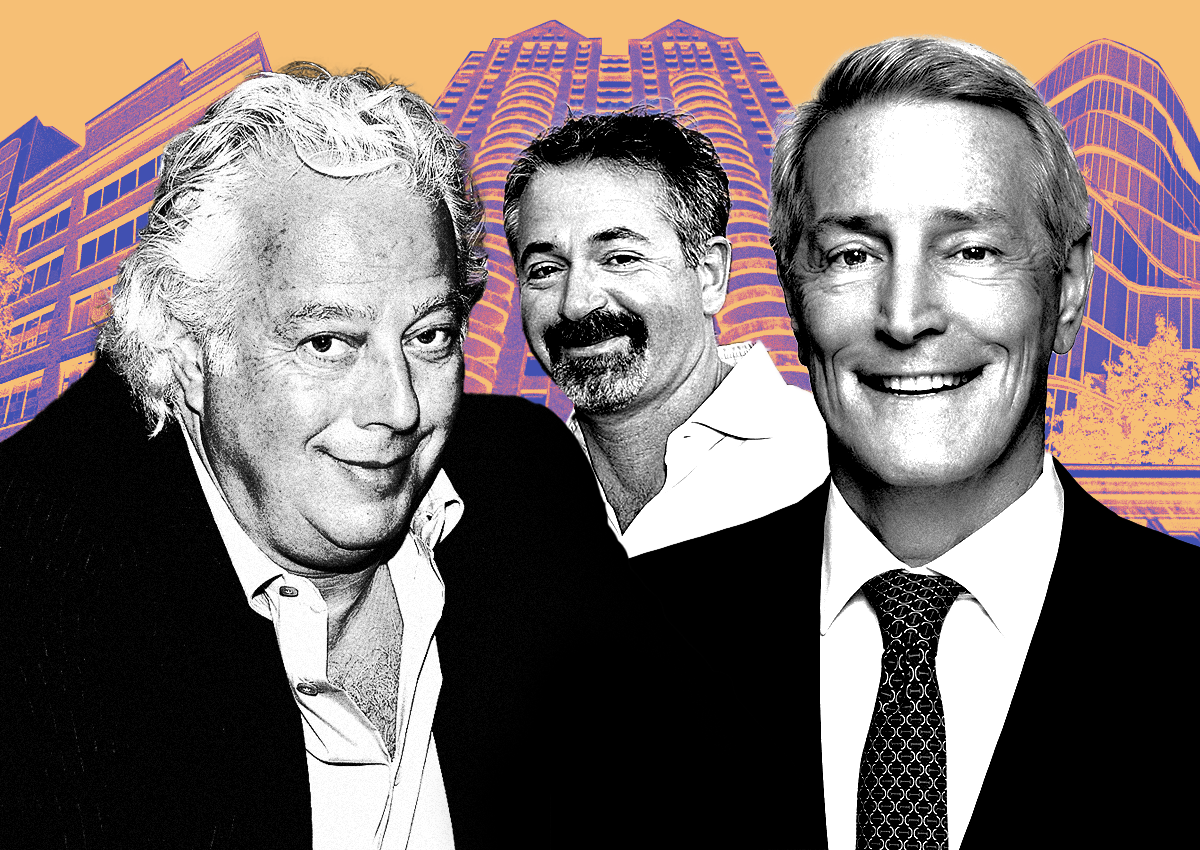

ialto Capital Advisors has intensified its foreclosure campaign against Signature Bank borrowers, filing lawsuits at an unprecedented rate. Aby Rosen and Michael Fuchs are bearing the brunt of Rialto's legal onslaught, with six suits alleging they defaulted on a Signature mortgage or promissory note. The duo faces foreclosure on several properties, including Midtown office buildings and a Chrysler Building ground lease.

Rialto has filed at least 37 cases alleging defaults since taking over the Signature loan book, with most seeking to foreclose. In the past six weeks, Rialto has sued borrowers to the tune of $458 million, surpassing an initial figure of $300 million. The servicer claims that Rosen and Fuchs defaulted on a $45 million loan backed by an Upper East Side retail condo in April 2023.

Rosen and Fuchs had secured a modification on the loan in 2022, making them liable for $15 million in principal in the event of a default. Rialto hit the borrowers with a default notice on the loan in February and then on the limited guaranty in November. The servicer claims that $65.7 million is now due on what had been $45 million in debt, thanks to 19 percent default interest.

Rialto's high-dollar suits against Rosen and Fuchs are not typical of its foreclosure filings, which often target small-scale owners or family firms with modest loans. Many borrowers have expressed fear and uncertainty about Rialto's aggressive tactics, including a Long Island hotel manager who received a default notice demanding $443,000 in fees.

Some landlords have alleged that Rialto contrived defaults to squeeze them for fees or their assets, but few have taken the servicer to court. Two owners have sued Rialto, alleging it manufactured financial obligations and failed to acknowledge extension requests. The Federal Deposit Insurance Corporation has sought to bump one of these cases from state court to federal.