A

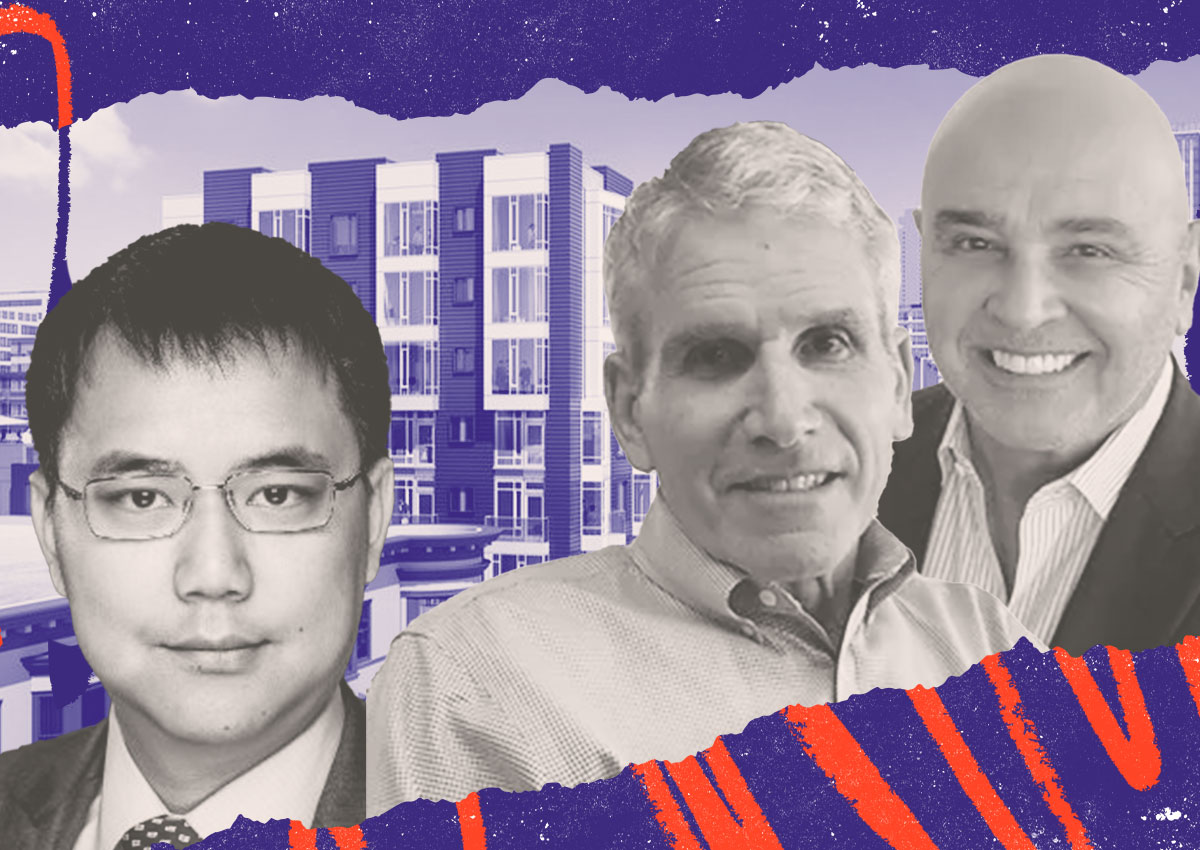

Los Angeles-based lender, Lone Oak Fund, is seeking to foreclose on a stalled condominium project in San Francisco's South of Market neighborhood. The city has deemed the site a public nuisance due to its condition, which includes graffiti, garbage, mosquito infestations, and standing water. Leap Development, the developer behind the project, owes over $1 million in fines related to the property.

Lone Oak Fund is pursuing a judicial foreclosure after Leap ceased making interest payments on a $10 million loan tied to the dormant project at 360 5th Street. The lender has asked the court to appoint a receiver to oversee the site. In its complaint, Lone Oak alleges that Leap's affiliate, San Mateo-based 360 Fifth, failed to repay the loan in full when it matured in June.

Leap Development had initially planned to build 127 condominiums on the two-thirds acre site, but construction was halted in 2020 due to the pandemic. The project's contractor, Thompson Builder, has filed a lawsuit against Leap claiming $5.8 million in unpaid work. Leap purchased the approved development site for $21.7 million in 2018 and listed it for sale last summer at an undisclosed price.

The foreclosure suit also reveals that $2.5 million from the sale of another Leap-owned project in San Bernardino County was used to pay down the $10 million loan, but Leap stopped making interest payments on the loan in November. A check written by Leap to Lone Oak Fund was returned due to insufficient funds.