L

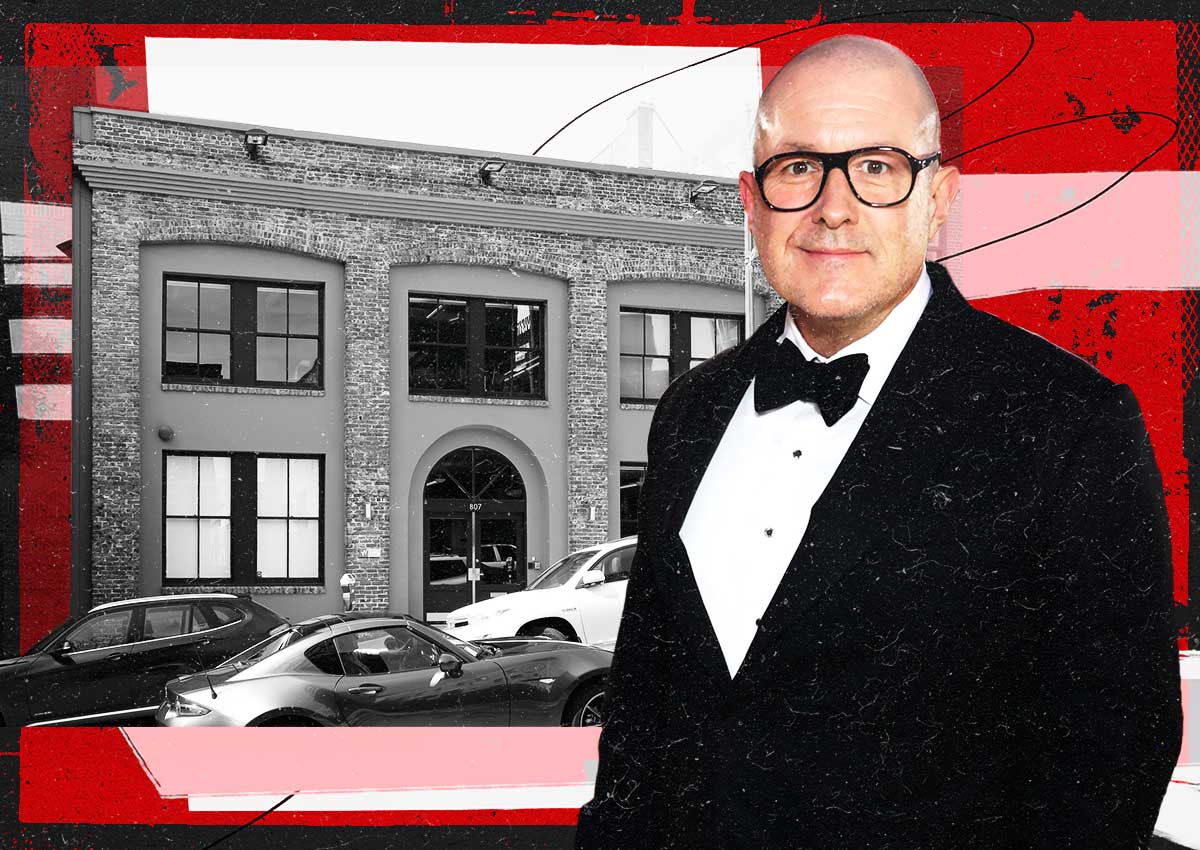

os Angeles investors Josh and Daniel Sabah, who sold a San Francisco office building for $38 million in 2023, are now suing the city to recover $1.6 million in transfer taxes. The lawsuit claims that the buyer paid three times the assessed value of the 119-year-old brick offices at 807 Montgomery Street, which is valued at $12 million according to an appraisal. The Sabahs argue that the $2.3 million transfer tax charged on the sale was excessive and should have been closer to $660,000.

The buyer paid a premium of $26 million for the property, which works out to $3,654 per square foot. This is significantly higher than the prices of vacant office buildings in Downtown San Francisco, which were trading at discounts of less than $300 per square foot at the time of sale. The Sabahs' lawsuit claims that the buyer paid a premium price because they wanted to purchase this specific building due to their relationship with a neighboring property owner.

The Sabahs have already petitioned the city for a refund last year, but were turned down. They are now seeking a refund through the courts. A spokesperson for the City Attorney's Office said it would respond to the lawsuit once it was served. Former District 3 Supervisor Aaron Peskin described the lawsuit as "outrageous, absurd, disgustingly greedy and not supported by the law."