A

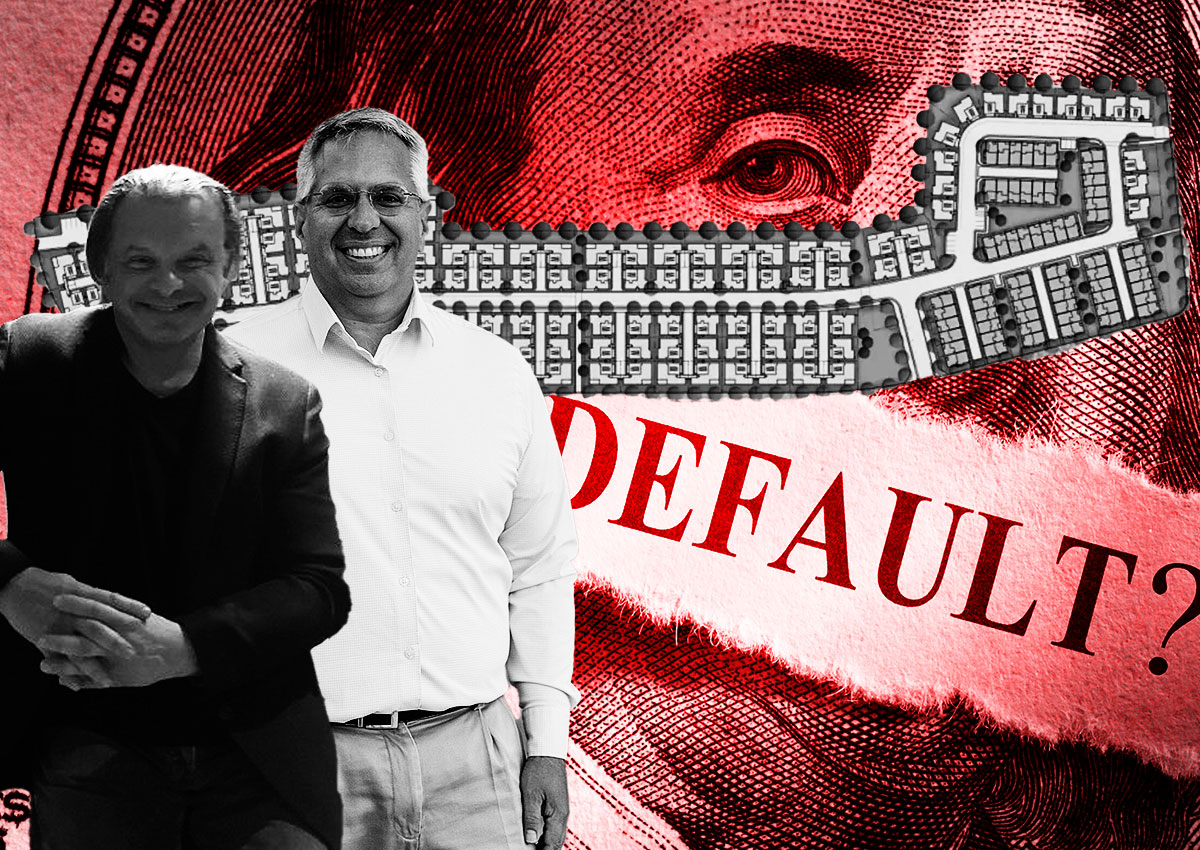

subsidiary of Cal-Coast Companies has filed for Chapter 11 bankruptcy after defaulting on a $24.9 million public loan tied to a waterfront development in San Leandro. Monarch Bay For Sale Residential LLC, controlled by the Los Angeles-based developer, defaulted on the loan linked to 15.9 acres at 2599 Fairway Drive within the larger Monarch Bay Shoreline project.

Despite the default and bankruptcy, city officials in San Leandro remain supportive of the project, which aims to transform a marina area into a mixed-use development with 206 for-sale homes, including 144 single-family homes and 62 townhouses. The project is part of a 75-acre redevelopment that also includes a hotel, restaurant, library, golf course, market, shops, and a waterfront park.

The city provided the loan to Cal-Coast in late 2022 when it bought the land for $29.9 million. Plans call for 491 for-sale homes and apartments, as well as other amenities. The development agreement was signed in 2020 but stalled during the pandemic. Cal-Coast made payments on the loan until January, when it fell into default.

The bankruptcy reorganization is expected to take nine months, delaying the project's progress. City staff continues to work with Cal-Coast to obtain permitting approvals and move forward with the development. The property is now held by a U.S. Bankruptcy Court Trustee, who plans to work cooperatively with the city to complete the project.