M

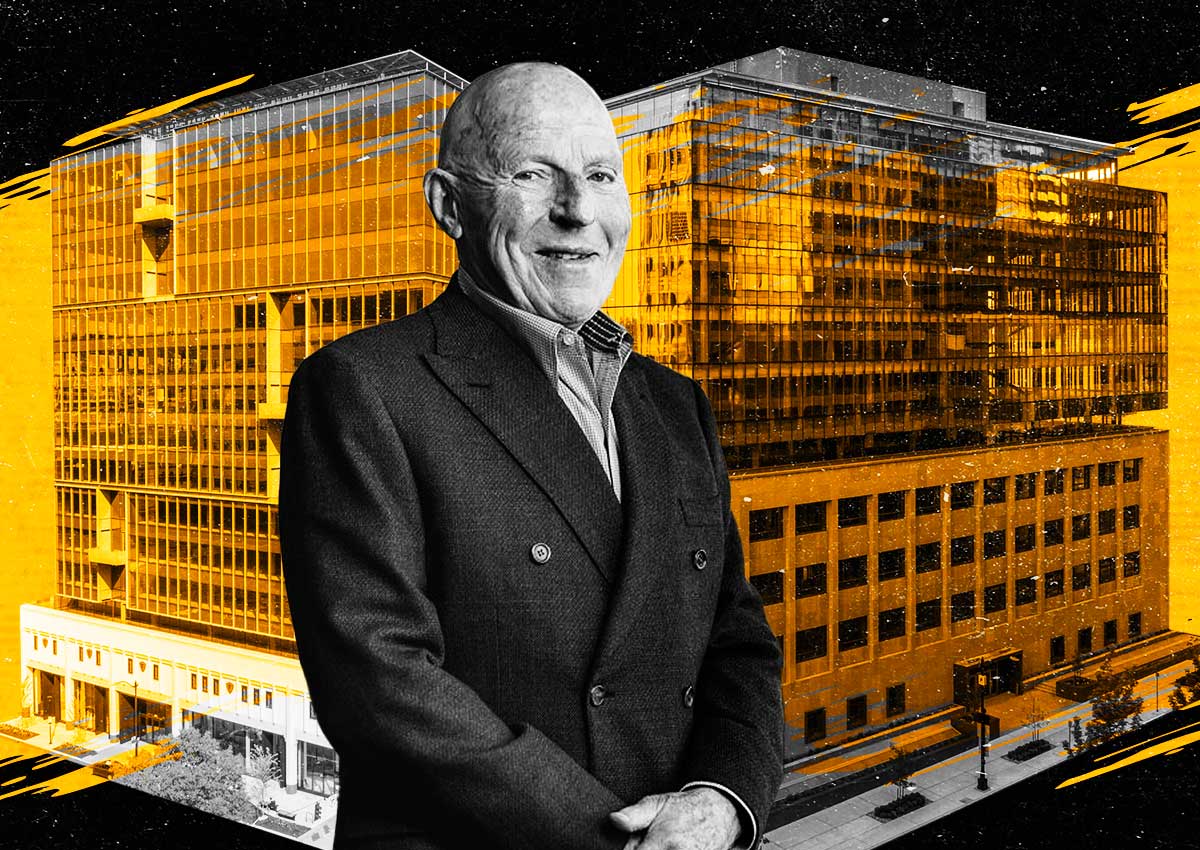

artin Selig Real Estate, a prominent Seattle-based developer, has defaulted on a $240 million loan tied to two of its most valuable office buildings. The company failed to repay the debt secured by a 15-story tower in South Lake Union and the former Federal Reserve Building converted into offices in Downtown Seattle.

The default is attributed to rising office vacancy rates, which have hit 35 percent in Downtown Seattle, according to CBRE. This is worse than during the Great Recession, when the Downtown vacancy rate was 21 percent. The company's struggles are not unique, as many office landlords across the nation face similar challenges due to high interest rates and declining building values.

Martin Selig Real Estate owes $221 million in principal plus $60 million in interest and late charges for a total of $282 million on its delinquent loan. The company may transfer the two buildings to Acore Capital as part of a broader strategy to restructure its debt and divest select assets.

The default is seen as a significant blow to Selig, who once owned a third of Downtown Seattle's offices, including the 76-story Columbia Tower. The company has struggled to pay its bills due to high vacancies at its over 30 office buildings since the shift to remote work.