B

ME, a leading player in the financial sector, has become one of the main shareholders of OpenBrick, a digital platform for tokenized real estate securities. This investment reinforces SIX's commitment to exploring new opportunities in the digital assets space.

OpenBrick, founded by Grupo Lar, Renta 4 Banco and ioBuilders, has welcomed BME, Garrigues and Teras Capital as strategic partners. The company aims to revolutionize the way real estate projects are financed through its blockchain-based platform, connecting issuers, investors and financial intermediaries.

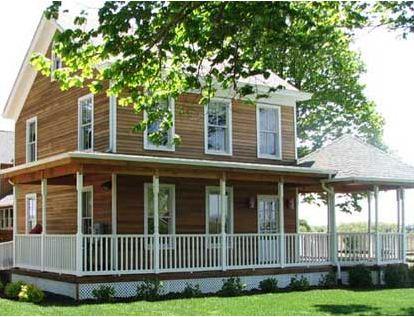

The OpenBrick platform enables the issuance, management, trading and settlement of tokenized securities linked to a wide range of real estate projects. This innovative approach provides liquidity to investment portfolios and acts as a non-bank financing channel for real estate players. By leveraging blockchain technology, OpenBrick streamlines fundraising through equity or debt instruments, making it faster and more efficient.

OpenBrick has received a favorable pre-assessment for admission to the CNMV Sandbox in February 2023 and expects to obtain an EU license to operate via BME by 2025. As platform operator, BME will manage the trading and settlement system with DLT technology under the EU Pilot Regime.