I

n a recent development, Beacon Capital Partners and 3Edgewood have taken over a 1.6 million-square-foot office complex in El Segundo after the joint venture between Starwood Capital and Artisan Ventures defaulted on nearly $500 million in debt. The Real Deal has learned that this transfer took place after the partnership completed a deed-in-lieu agreement on Aug. 27, which allowed Beacon and 3Edgewood to convert their debt position into equity. The exact amount paid by the buyers for the property is not disclosed, but sources suggest that it was significantly discounted from the loan balance.

This acquisition comes just months after Beacon and 3Edgewood lost a nearby 257,000-square-foot office complex to lenders. The complex, known as Pacific Corporate Towers, is comprised of three office buildings located at 100, 200, and 222 Pacific Coast Highway. The property is partially leased to coworking firm WeWork, which signed a lease for three floors in 2018.

Beacon Capital, based in Boston, also owns Pacific Concourse, a 162,000-square-foot office complex in El Segundo, which they acquired in a $43 million deal in 2018. In March, Starwood and Artisan were reportedly in negotiations with Morgan Stanley over approximately $600 million in debt on the Pacific Coast Highway property. At the time, the complex was reportedly half empty and valued at less than $400 million.

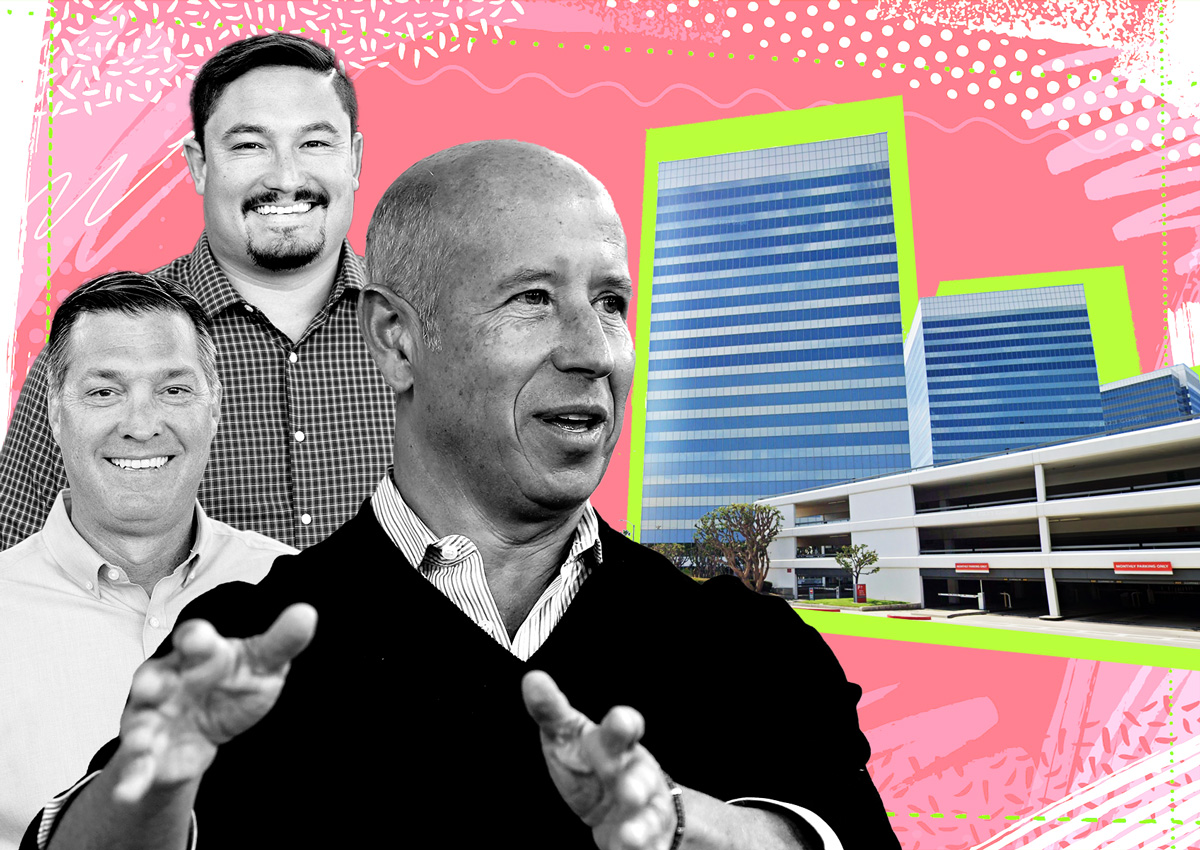

This transfer marks a significant loss for Starwood, as the property's most recent valuation is significantly lower than the $605.5 million that Starwood paid in 2017. The El Segundo transfer is just one of several losses for Starwood, as they also lost a property next door at 1960 East Grand Avenue in July. Additionally, they planned to build a 94,000-square-foot office property in an adjacent parking lot but were unable to do so due to financial constraints.

Starwood also recently surrendered three office towers in Oakland, further adding to their list of losses. New York-based Starwood Capital Group is a private investment firm run by CEO Barry Sternlicht. Artisan Ventures is an investment firm based in Santa Monica and run by Collin Komae and Mark Laderman, both managing partners, according to its website.