F

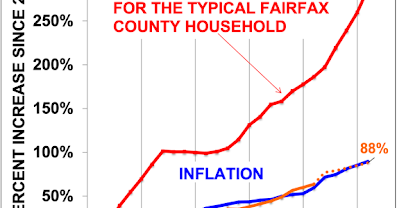

airfax County's real estate tax hike would still be 6.2% even with a new meals tax. For the past 25 years, the county has increased real estate taxes three times faster than household income. This year, residential assessments rose by 6.2%, meaning that unless the supervisors adjust the tax rate, the average homeowner's real estate tax will increase accordingly.

However, instead of reducing the tax rate to offset the assessment hike, the Board of Supervisors is adding a new meals tax and increasing the tax rate by 1½ cents. This would push the average homeowner's tax bill up by 7.5%, the largest real estate tax increase in 10 years. The average homeowner's tax bill would rise from $8,659 to $9,312.

The Board of Supervisors will decide on the tax rate and meals tax by May 6. Raising pensions and medical insurance are primary drivers of soaring real estate taxes. The county demands $300 million in new revenue annually for 4% raises to 40,000 employees, outpacing inflation. Pensions are costly, with the county contributing 34% of salary.

What do these rising taxes buy? A 40-point drop in SAT scores while school funding increased by $600 million. The Thomas Jefferson High School for Science and Technology has fallen from 1st to 14th in rankings. There's unaffordable housing, slow permitting for businesses, and an increase in public assistance recipients.

The Fairfax County Taxpayer's Alliance recommends limiting real estate tax increases to household income growth rate, running quality schools, streamlining salary increases, and auditing county programs.