A

ustralia has experienced three major interest rate cutting cycles since 2015, each with distinct impacts on the housing market. The Reserve Bank's gradual easing from May 2015 to May 2016 saw rates fall from 2.25 per cent to 1.50 per cent, followed by aggressive cuts from June 2019 to late 2020 that took rates to a historic low of 0.10 per cent.

Analysis of suburb-level data reveals each cycle has benefited different segments of the market, with the most responsive areas shifting based on economic context and buyer demographics. The current cutting cycle, beginning in 2024 from multi-year highs above 4 per cent, represents the third distinct easing phase in a decade.

Rate cut sensitivity is measured by comparing annual price growth during cutting periods against pre-cutting baseline growth. Suburbs showing consistent positive acceleration across multiple cycles are identified as reliably rate-sensitive, while those with the highest growth during cutting periods demonstrate maximum sensitivity to monetary easing.

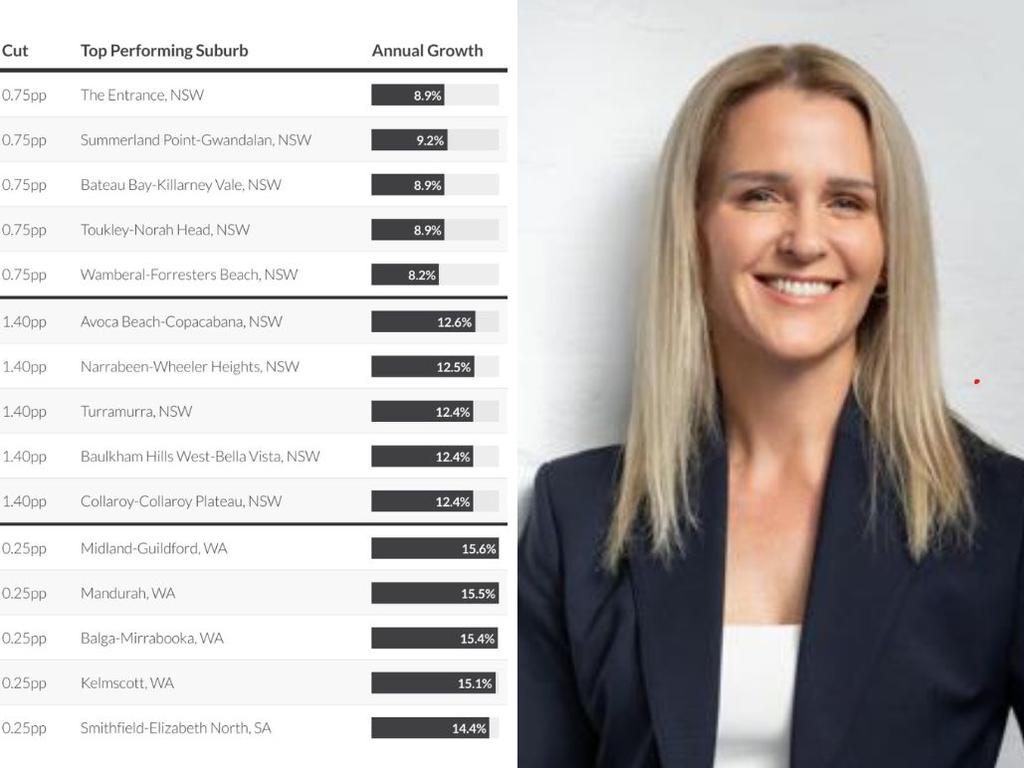

The first cycle (2015-2016) primarily benefited coastal lifestyle markets within commuting distance of major cities, with NSW's Central Coast emerging as a standout performer. Areas such as Avoca Beach-Copacabana and Wamberal-Forresters Beach led the market response, attracting people looking for coastal lifestyles with commuting distance to Sydney.

The second cycle (2019-2021) saw unprecedented rate cuts lead to strong responses in Sydney's premium suburbs, with areas like Turramurra and Castle Hill precincts posting double-digit gains. The biggest acceleration occurred in Castle Hill areas, where suburbs swung from negative growth to positive growth of over 12 per cent.

The current cycle (2024-2025) has fundamentally reversed previous patterns by most benefiting affordable, outer suburban areas. Perth's Midland-Guildford and Mandurah have led national growth rates, with Adelaide's outer suburbs also responding strongly. These areas represent traditional first homebuyer territories where borrowing capacity improvements from rate cuts have the greatest impact.

The evolution of rate cut beneficiaries across three distinct cycles reveals fundamental shifts in Australia's housing market dynamics. From emerging coastal lifestyle markets to premium Sydney suburbs and now affordable outer areas, each cycle is different. The Central Coast's consistent performance suggests certain markets maintain enduring rate sensitivity, but the dramatic swing from million-dollar suburbs to sub-$750,000 areas demonstrates how affordability constraints now dictate market responses.