S

tate and local governments are introducing their own versions of the "Taylor Swift Tax" to boost revenue, but not everyone is pleased with this trend. Rhode Island took a bold step by imposing a significant tax hike on high-end real estate, targeting second homes valued at over $1 million. This move has sparked backlash from real estate insiders and wealthy buyers.

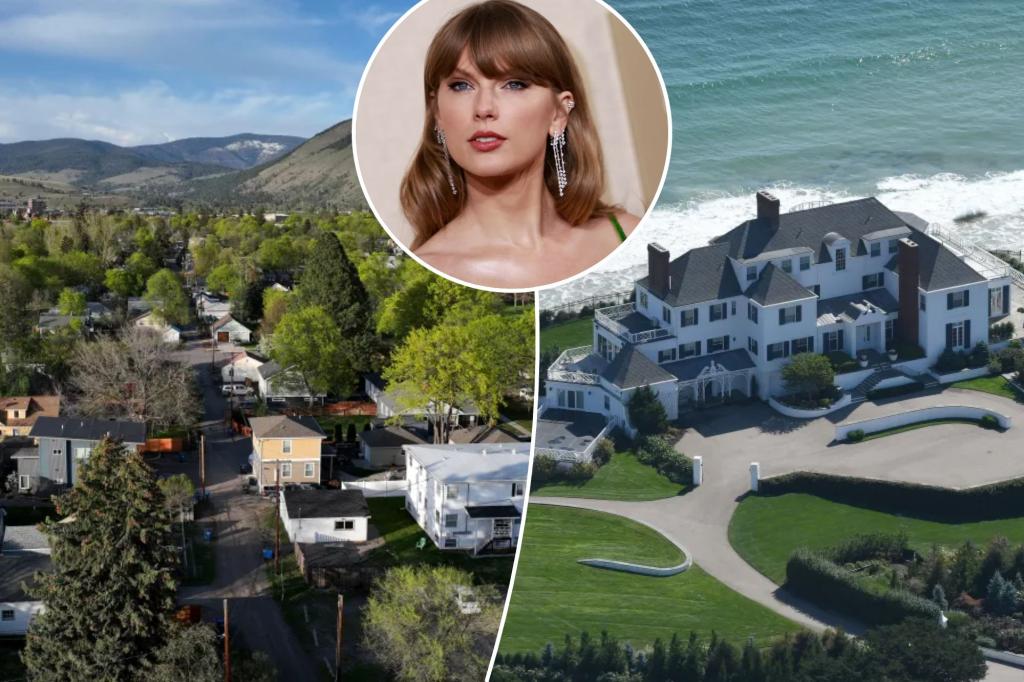

The tax, which was nicknamed after the state's pop star resident, will increase property taxes for non-primary residents by $2.50 for every $500 of assessed value above $1 million. Taylor Swift's own property taxes could rise by nearly 68%, according to estimates, due to her ownership of a seaside mansion in Rhode Island.

The tax is part of a wave of similar measures across the country, with Los Angeles and Montana adopting their own versions. Brokers argue that these surcharges harm local economies and drive away big spenders who contribute to property deals. "It's a smack in the face," said Donna Krueger-Simmons, a Sotheby's broker in Rhode Island.

Montana's two-tiered property tax plan has also faced criticism from brokers, who claim it hurts small businesses and slows down the market. Los Angeles' "mansion tax" has generated disappointing returns, falling short of projected revenue. Despite this, Cape Cod is considering a proposed transfer tax on homes over $2 million to address its housing shortage.

The trend of property surtaxes shows no signs of slowing down, with Rhode Island set to introduce a similar conveyance tax in October. While proponents argue that these measures will generate much-needed revenue, critics warn that they could have unintended consequences for local economies and property markets.