T

his lesser-known $7 billion company deserves attention from income-focused investors.

If you're searching for a new dividend payer, Agree Realty (ADC) might be worth considering. As an REIT, it owns rent-generating real estate and distributes the majority of its profits to shareholders. Unlike most REITs, which focus on apartment complexes, office buildings, or malls, Agree Realty specializes in stand-alone stores and strip mall retailing.

While this may seem riskier due to e-commerce's growth, a closer look reveals that many vacant stores have been reoccupied, with over 6,000 new store openings in the US this year. This suggests a reshaping of the retail industry rather than an implosion. Agree Realty owns 47 million square feet of retail space across 2,271 properties, making it well-positioned to benefit from this trend.

There are three compelling reasons to invest in Agree Realty:

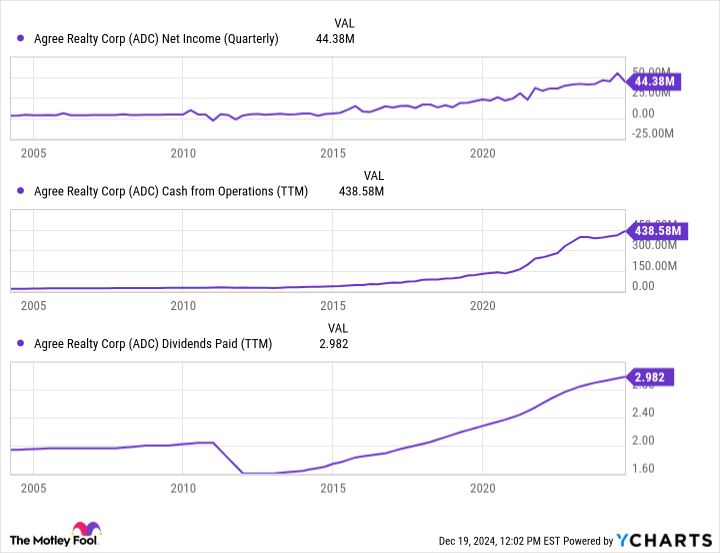

1. Its dividend yield stands at 4.3%, significantly higher than the S&P 500's 1.3% trailing yield.

2. The REIT has consistently paid and grown its monthly dividend since its IPO in 1994, with a net average annual return of 12.3%.

3. Agree Realty's top tenants include resilient retailers like Walmart, Tractor Supply, and Dollar General, which account for about one-third of its annual rent revenue.

The company's strong fundamentals and discounted price make it an attractive investment opportunity. Despite recent setbacks, the analyst community remains bullish on Agree Realty, with a consensus price target of $80.47 (14% above its current price). If you're seeking a reliable dividend payer with above-average yield, Agree Realty is worth considering.