T

he closure of Upriver Studios in Saugerties after only four years in business has raised questions about the viability of New York's tax credit program for filming. Despite attracting productions like "Pretty Little Liars: Original Sin," the company was unable to overcome industry challenges such as the pandemic and labor strikes, ultimately drawing on $4.6 million in private debt and equity. The future of the building that housed the soundstages, owned by Peak Trading Corporation's Kevin Pitcock, remains uncertain.

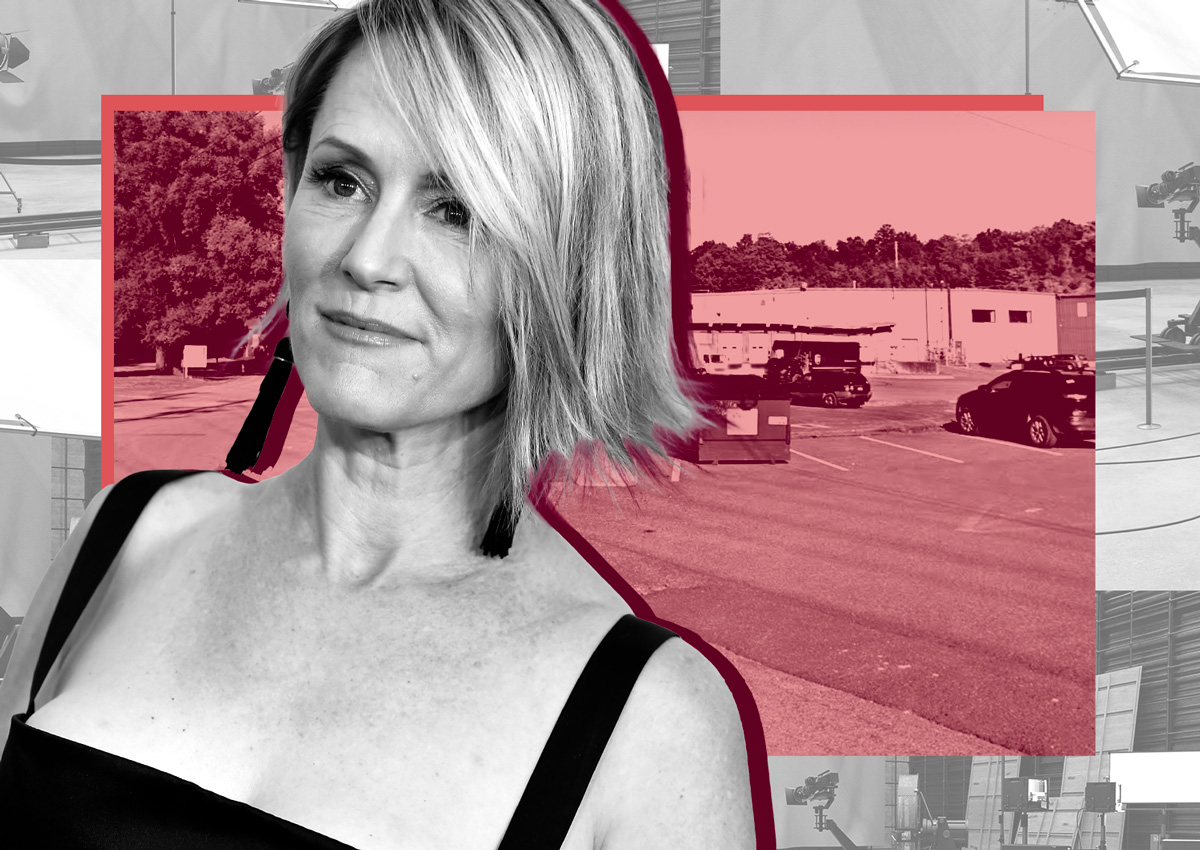

Actress Mary Stuart Masterson, a co-founder of the company, expressed optimism about the film industry upstate despite her own studio's struggles. However, the closure has raised concerns about the draw of New York as a production destination outside of the five boroughs of New York City. The state's 2023 budget increased the tax break cap for eligible productions to 30 percent, plus an additional 10 percent for those that flock upstate. The $700 million tax credit program is the state's largest industry-specific break.

A state report released in January found that for every dollar given via the tax break from 2018 to 2022, only 15 cents in direct tax revenue was generated. After Upriver Studios' closure, only one large-scale soundstage remains in the Hudson Valley. As New York's position in the filming landscape grows shaky, neighboring New Jersey has seen an onslaught of productions since reviving its own tax credit program in 2018, which avails productions to an annual pot of $300 million.

In a nearby development, a film studio is planned for East Fishkill in the Hudson Valley. The Daily Dirt: Studio development, productions rise in NY and NJ, and New York studio surge stealing spotlight from Hollywood are related articles that provide further insight into these topics.