H

omebuyers looking for their forever home may want to consider the top housing hotspots of 2025, according to the National Association of Realtors (NAR). The association's list focuses on economic demographics and housing factors that could impact local markets. Lawrence Yun, NAR chief economist, predicts a more favorable market next year, with stable mortgage rates and increased inventory paving the way for homeownership.

The NAR expects mortgage rates to stabilize around 6 percent in 2025, which is considered a "new normal." Home prices are also expected to increase by around 2 percent per sale. Despite this, the association predicts around 4.5 million existing home sales nationwide in 2025.

Some of the top housing hotspots include:

* Boston-Cambridge-Newton, Massachusetts-New Hampshire: This region has a high average home price of $694,494, but is expected to benefit from stabilizing mortgage rates.

* Charlotte-Concord-Gastonia, North Carolina-South Carolina: With 43 percent of homes priced below $324,000, this area offers affordable housing options and job growth.

* Grand Rapids-Kentwood, Michigan: The average home price in Grand Rapids is $271,960, making it an attractive option for homebuyers. Mortgage rates are around 6.9 percent, but areas in the region have mortgage originations with less than 6 percent rates.

* Greenville-Anderson, South Carolina: This area has a variety of affordable housing options, with 42 percent of starter homes available to buy. The housing market average is $307,315, up 2.6 percent from last year.

* Hartford-East-Hartford-Middletown, Connecticut: With an average home price of $178,696, Hartford offers low prices compared to other US cities. Mortgage rates are also relatively low at 6.5 percent.

* Indianapolis-Carmel-Anderson, Indiana: About 42 percent of Indianapolis' housing stock is less than $236,000, making it a competitive market for homebuyers.

* Kansas City, Missouri-Kansas: The average home cost in Kansas City is $233,826, with a lower average mortgage rate and fewer locked-in homeowners.

* Knoxville, Tennessee: This city has an affordable housing market, with an average home value of $350,614. Homebuyers can choose from over 1,500 properties currently on the market.

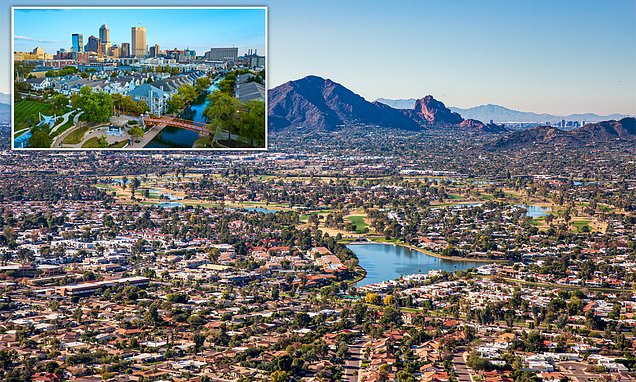

* Phoenix-Mesa-Chandler, Arizona: With an average home value of $414,977, this region is known for its affordable housing stock and lower cost of living. Job growth and demographic shifts have established Phoenix as a prosperous market.

* San Antonio-New Braunfels, Texas: This area has seen strong job growth over the past few years and has a massive sales inventory of over 7,100 properties. The average home price is $250,834, with 62.2 percent of sales under listing price.