T

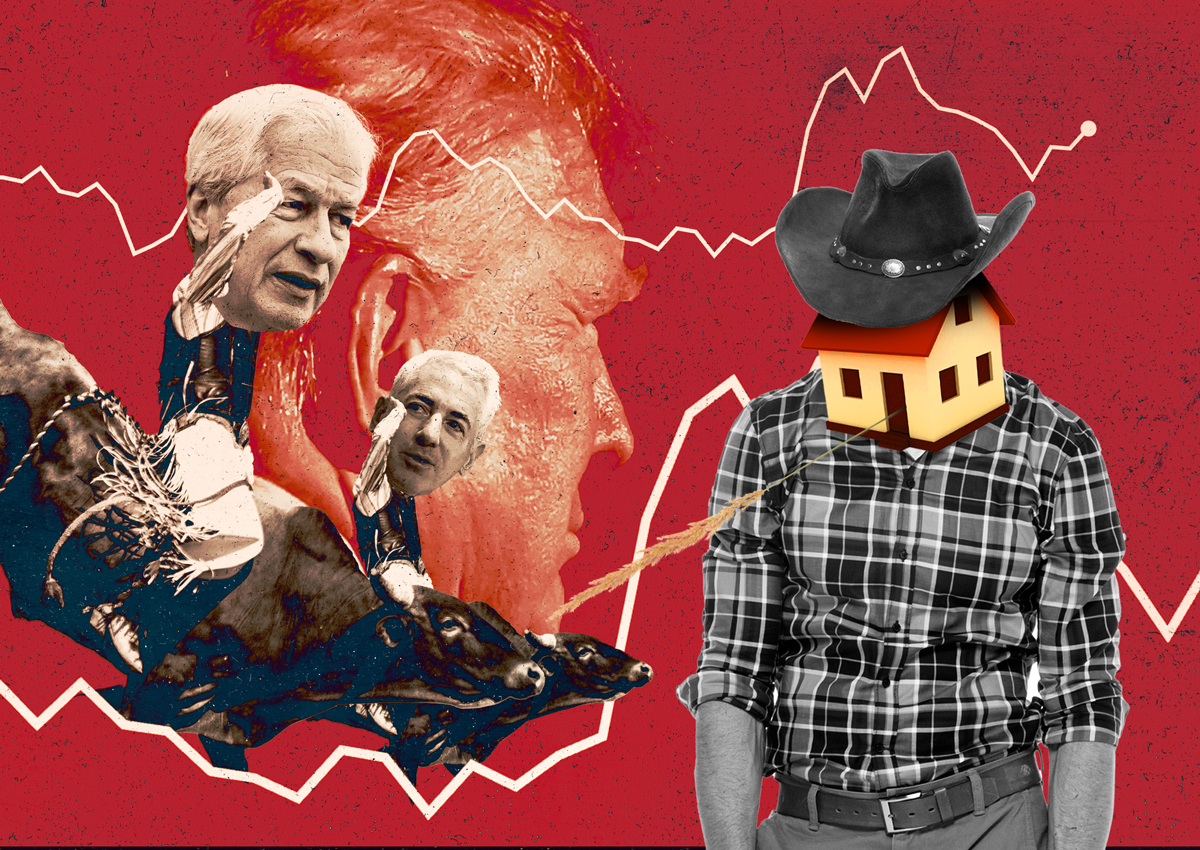

he tariff tumult has been a dominant topic, with even the most vocal critics momentarily silenced. Hedge fund manager Bill Ackman initially blasted Trump's "Liberation Day" tariffs as a recipe for disaster, only to later praise the president's reversal as a masterstroke. Meanwhile, Citadel's Ken Griffin and Jamie Dimon expressed concerns about a potential recession triggered by the initial tariff plan.

However, New York City's real estate industry has been strangely quiet on the issue. The Real Estate Board of New York (REBNY) issued a statement that was more notable for its brevity than its content. "We're watching closely and analyzing potential impacts to project costs," said REBNY president James Whelan.

The industry's reticence may be due in part to the fact that real estate has yet to feel the full brunt of the tariffs. Unlike Wall Street, which is more sensitive to short-term market fluctuations, real estate views threats as weeks or months down the line. "Nothing has actually changed yet," said MaryAnne Gilmartin, CEO of MAG Partners.

Developers and lenders have expressed similar sentiments, with some noting that the industry had recently weathered a correction when interest rates soared and valuations plummeted. An anonymous lender speculated that real estate stayed calm because it had already experienced its own crisis, making the tariff threat seem relatively minor in comparison.

Crunching the numbers on the costs of Trump's aluminum and steel tariffs has revealed minimal impact on total project costs. Gilmartin estimated that tariffs account for only 2 percent of total costs in a new multifamily development, while Maurice Regan, CEO of construction firm JT Magen, said they have had no effect on his business.

Despite the industry's relative calm, New York City politicians were quick to claim Trump's policies had negatively affected development. Manhattan Borough President Mark Levine tweeted that real estate projects "have already paused or been canceled because of these disruptions." However, The Real Deal was unable to confirm a single project delay or cancellation.

Industry sources reported microshifts in business approaches, with some developers pre-buying materials and lenders leaning more conservative in their underwriting. While no developments appear to be scrapped, the whipsawing has frustrated some and exhausted most. "It's another curveball but boy this one's a tough one," said Rosie Tilley of multifamily and condo developer Charney Companies.

As trade policy remains a moving target, it's clear that real estate execs are bracing for the next executive decision. "This guy could come out tomorrow and say the tariffs are back on; it's just an impossible environment to handicap," said a commercial lender.