T

he Trump administration is advancing a proposal for a 50‑year fixed‑rate mortgage, a move officials say could make homeownership attainable for millions of Americans facing sky‑high prices and growing affordability worries.

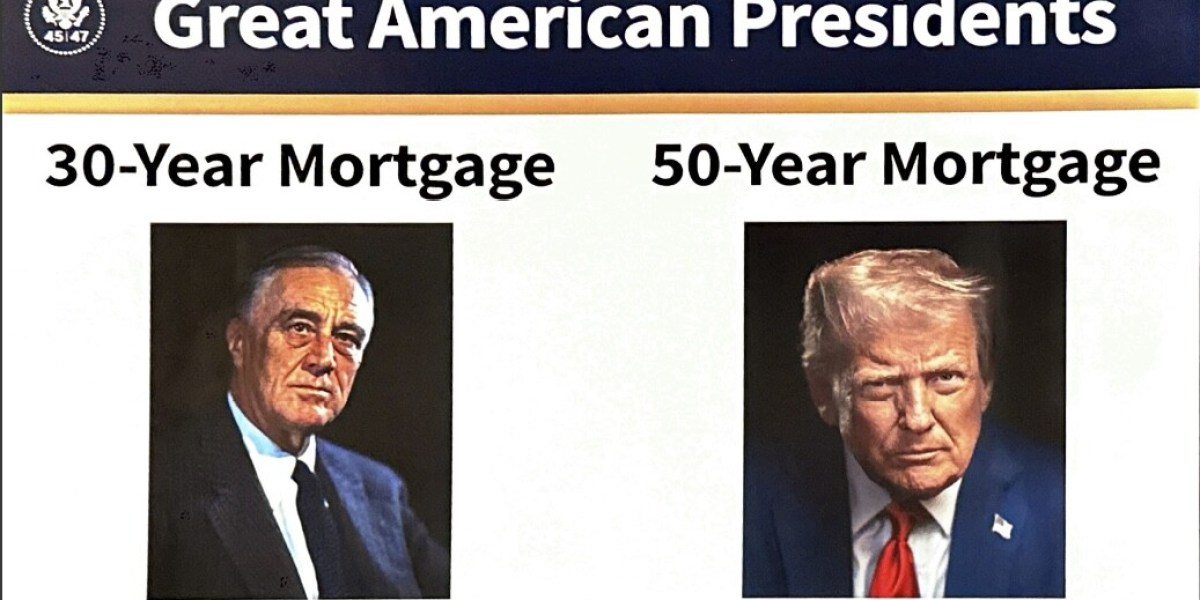

Federal Housing Finance Agency director Bill Pulte announced the plan on social media, calling it “a complete game changer.” He followed President Trump’s recent graphic that compared the new 50‑year concept to the 30‑year fixed‑rate policy championed by Franklin D. Roosevelt during the New Deal.

With 30‑year rates stuck above 6 % for more than three years, many potential buyers are priced out. Redfin data shows the median U.S. household spends roughly 39 % of its monthly income on mortgage payments—well above long‑term affordability benchmarks. The “lock‑in” effect keeps many homeowners from selling because they fear losing the low rates they secured before the 2022 rate hike, creating a market gridlock that pushes ownership further from younger Americans.

In response, adjustable‑rate mortgages (ARMs) have surged, now making up over 10 % of new mortgage applications—the highest share since 2021, per the Mortgage Bankers Association. Pulte has blamed Fed Chair Jerome Powell for keeping rates “artificially high” and emphasized that the administration is “laser‑focused on ensuring the American Dream for young people.” He framed the 50‑year mortgage as one tool in a broader arsenal of solutions.

A 50‑year loan would lower monthly payments by extending the amortization period. For example, Fannie Mae’s calculator estimates that a $400,000 home with a 6.575 % rate and 20 % down would cost $2,788 per month on a 30‑year fixed, $2,640 on a 40‑year, and $2,572 on a 50‑year term.

Critics warn that longer terms raise total interest, slow equity buildup, and increase default risk in downturns. Economist Tyler Cowen, using GPT‑5, concluded that a government‑backed 50‑year mortgage would likely lower monthly payments but raise house prices, slow equity accumulation, and heighten interest‑rate risk for the financial system. In the short run, sellers and incumbent owners would reap most benefits, while first‑time buyers would face higher entry prices.

The average age of first‑time buyers has climbed, reaching 40 in 2025—the highest on record, according to the National Association of Realtors. As ResiClub’s Lance Lambert noted, the typical first‑time buyer is almost as close to collecting Social Security as to finishing high school.

Pulte’s comments came after his appearance at ResiDay, a residential real‑estate conference. He hinted that Fannie Mae and Freddie Mac might take equity stakes in private companies, mirroring the unprecedented Intel deal, and said, “We hold all the cards.”