M

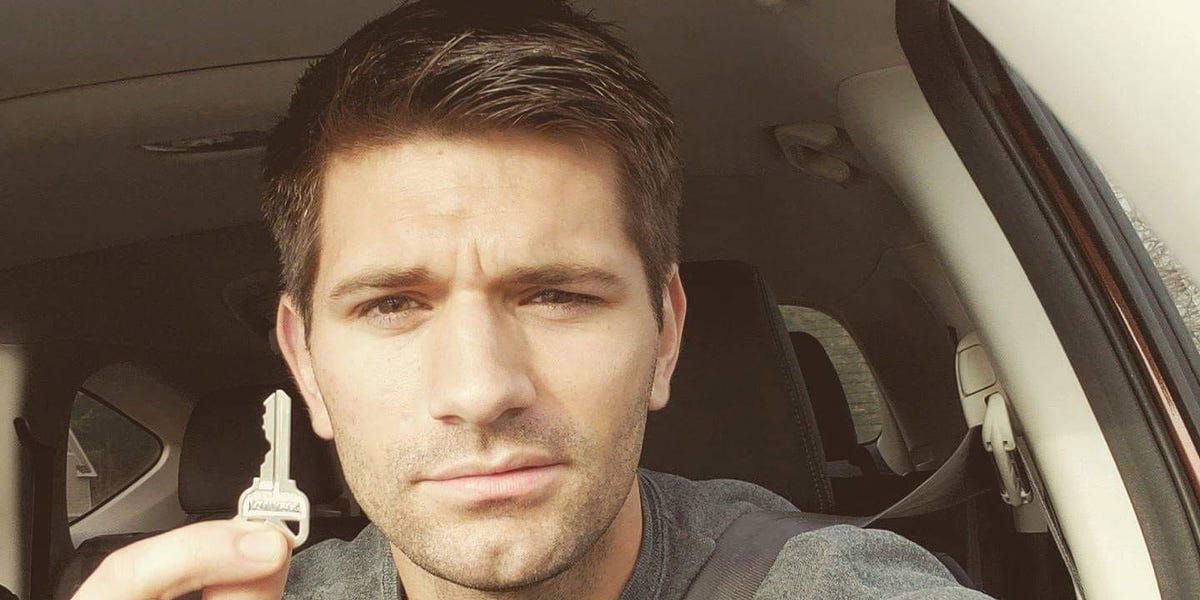

ike Newton’s first real‑estate venture began in 2018 when he purchased a duplex near Seattle. Unable to afford a full‑investment down payment, he used owner‑occupied financing, putting down only 5% and living in one unit while the other was rented. The rent covered most of the mortgage, and a roommate in his own unit further reduced costs, allowing him to save for his next purchase. Newton now owns more than ten units and credits this “house‑hacking” method as a low‑risk entry into property ownership.

Across the country, investors are turning to multifamily buildings—duplexes, triplexes, fourplexes—because they deliver stronger cash flow than single‑family homes. Dana Bull, a Massachusetts broker and coach, calls them “triple‑headed monsters” for the three key advantages they offer: acquisition discounts, economies of scale, and a single roof and driveway to maintain. She notes that a three‑family house only needs one roof replacement, one driveway, and shared hallways, simplifying upkeep compared to multiple single‑family homes.

Josh and Ali Lupo, who own several New York multifamily properties, say that rising prices and interest rates have made long‑term rentals less attractive. Their portfolio helped them pay off six‑figure student loans and achieve financial independence. In 2025, they and other investors are prioritizing larger units—at least three stories—because cash flow and cap rates are more favorable. Connor Swofford and Pieter Louw, who started buying in 2024, now manage over twenty units in Buffalo. They moved away from duplexes after realizing that larger multifamily properties yield better returns and lower risk.

For beginners, residential loans—including low‑down‑payment programs—make multifamily investing accessible. If you intend to occupy the property, you can qualify for owner‑occupied financing, which often requires only 5–10% down. This approach lets you generate income from tenants while living in the same building, effectively offsetting or eliminating the mortgage. It also provides a practical test of landlord responsibilities without the full financial commitment of a traditional investment property.

Not every market has a plentiful supply of multifamily buildings. In New England, many such structures date back to the late 1800s and early 1900s, built to house workers near cities like Boston. Where multifamily units are scarce, house hacking can still be achieved by adding an accessory dwelling unit (ADU) or converting an unfinished basement into a rentable space. Alternatively, renting out a portion of a single‑family home or finding a roommate can bring in extra income. The key is to creatively use available space so that others help pay the mortgage.

In summary, multifamily properties are gaining popularity because they combine acquisition discounts, maintenance efficiencies, and strong cash flow. Owner‑occupied financing and house hacking lower entry barriers, making them ideal for new investors. By leveraging these strategies, many are building sizable portfolios while maintaining manageable risk.