D

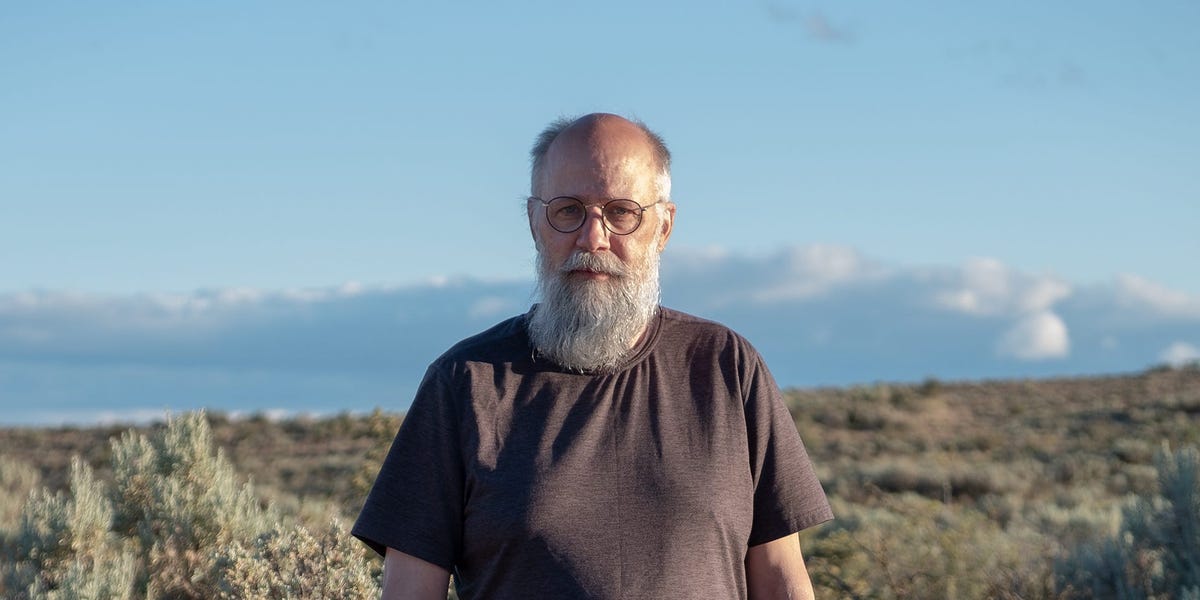

an Steven Erickson, a former community‑college instructor, has accumulated a $650,000 nest egg through a mix of modest teaching salaries, employer‑matched retirement plans, and real‑estate gains. He began working at 17 in low‑pay jobs, only entering college at 30. After earning a bachelor’s and master’s in communications, he taught in Kansas, where he joined the KPERs retirement program. A year later, following the loss of his first child, he moved to Indiana and then to Washington, where he taught for two decades and had a daughter in 2005.

In 2012 he purchased his first Washington property, selling it in 2019 for a $70,000 profit that cleared student loans, credit‑card debt, and car payments. He relocated to Maine in 2022, continued teaching remotely, and bought a second Washington home in 2021, selling it in 2023 for a sizable gain. A third Maine property followed, but after two years he moved to Tennessee, renting the Maine condo to a relative to cover the mortgage while he worked in Tennessee.

He only began systematic investing five years ago, contributing 7 % of his income to a retirement plan that matched his contributions, plus an extra $200 monthly. By age 59 his accounts totaled $500,000; a $70,000 inheritance in 2022 brought the total to $570,000, and with $100,000 in real‑estate equity he reached $650,000.

Despite the sizable sum, Erickson feels uneasy. He has worked for the Postal Service, quit for low pay, and now splits time between part‑time retail at Cabela’s and teaching. A 2006 divorce left him single, and he worries that $650,000 will only support a $50,000 annual lifestyle for about 12 years. Health concerns and a desire to avoid relying on Social Security or public housing add to his anxiety. He plans to secure another Tennessee job, hoping to retire at 65 unless he remains passionate about his work.

Erickson regrets not investing in real estate earlier, noting that those properties significantly boosted his finances in his fifties. He longs to pursue creative endeavors—writing, music, photography—but is trapped in exhausting, unsatisfying jobs. His advice to younger generations is simple: start saving as soon as a matching program is available, even if the contribution is small; the compounding effect is decisive.