A

lternative assets offer new paths to wealth growth and portfolio diversification, but each comes with unique risks and rewards. Options like peer-to-peer lending, cryptocurrencies, fine art, farmland, and music investments have varying levels of volatility and potential returns. Some may provide faster returns, while others offer steady growth over time. The right choice depends on individual goals and risk tolerance.

Dennis Shirshikov, a finance expert, suggests that unconventional assets can outperform traditional real estate, which has seen an average annual return of 8.6%. Here are five alternative assets to consider:

Peer-to-peer lending offers returns between 5% and 12%, depending on loan risk profiles. While it provides better returns than traditional fixed-income investments, it also carries risks such as borrower defaults and liquidity constraints.

Cryptocurrencies can be highly volatile but offer the potential for significant returns, exceeding 100%. However, they also come with the risk of dramatic price fluctuations and uncertainty in legal frameworks governing them.

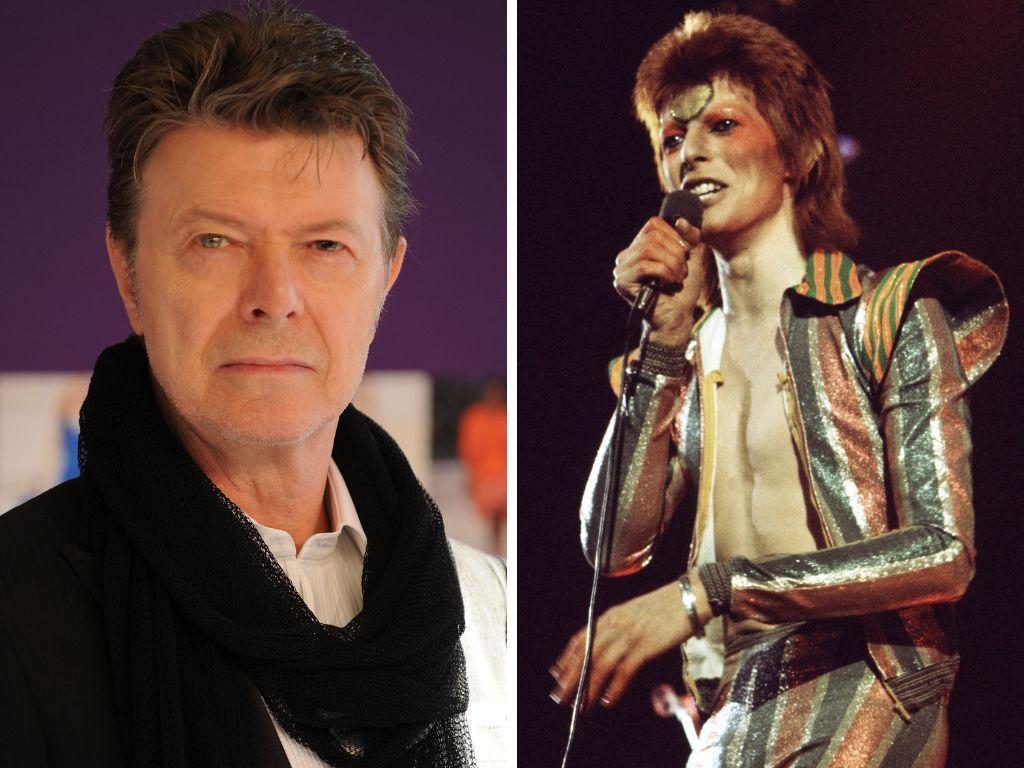

Fine art and collectibles can appreciate over time, offering annual returns between 5% to 15%, depending on market demand. These investments provide portfolio diversification due to their low correlation with traditional markets and are physical items that can increase in value.