A

Green Country woman narrowly escaped losing $100,000 to scammers who intercepted her emails while she was closing on a new home. The thieves posed as the title company and sent her fake wire instructions, but she caught the red flag and immediately called her agent. Fortunately, Curt Hendrix with Allegiance Title and Escrow intervened just in time, freezing the bank account where the money was being transferred.

Hendrix explained that scammers typically target individuals with unsecured email accounts, hacking into chains involving buyers, realtors, or lenders to create spoofed addresses that appear legitimate. They then send urgent wire instructions, hoping victims act quickly before realizing their mistake.

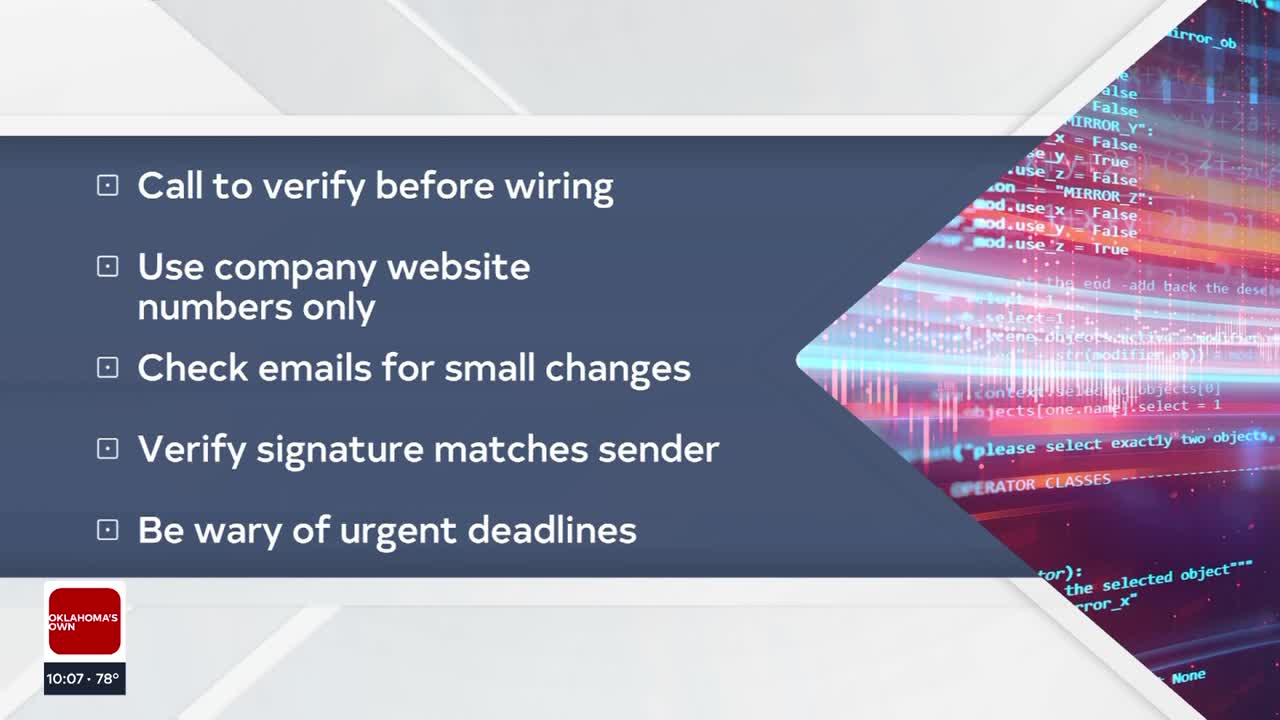

To avoid falling victim to these scams, Hendrix advises consumers to be diligent when receiving emails asking for money. Check the email address and signature line to ensure they match previous communications. Verify wire instructions over the phone using a number from the company's official website, not one included in an email.

Before wiring money, Hendrix emphasizes the importance of verifying everything. Consumers should always call and verify before sending funds, use phone numbers from official company websites, scrutinize email addresses and signature lines, and be skeptical of urgent deadlines that create fake pressure.

Recovering money in these cases is often difficult due to the ease with which scammers can open bank accounts using minimal identification. Hendrix notes that convincing banks to freeze their clients' funds can be a challenge.

To prevent falling victim to these scams, consumers should be proactive and take steps to secure their email accounts and verify wire instructions before sending money. As crime expert Lori Fullbright advises, be skeptical of any email or message asking you to click on a link, scan a QR code, or call a number, and set up two-factor authentication on all your accounts.