A

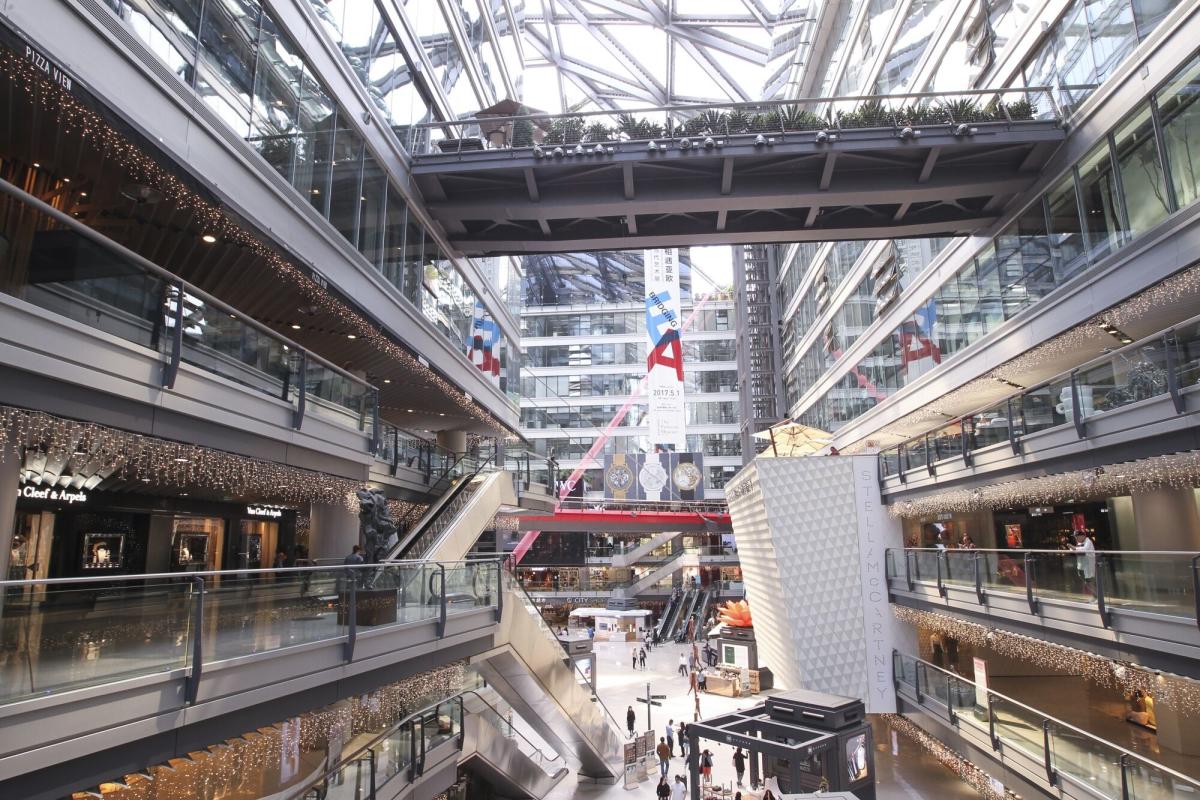

prominent commercial complex in Beijing's central business district is being sold by Hong Kong-based Parkview Group due to China's prolonged property downturn affecting its cash flow. The 200,000 square meter mixed-use development, known as Parkview Green or Fang Cao Di, includes a shopping mall, hotel, office towers and an arts hub. A Chinese state-owned firm has expressed interest in purchasing the asset, which features a unique pyramid-shaped structure.

Parkview Group is grappling with high mortgage payments and low occupancy rates in Beijing, according to people familiar with the matter. The company's rental income from Parkview Green isn't sufficient to cover loan interest payments, with an occupancy rate below 70%. A spokesperson for Parkview stated that interest on the facility has always been kept current.

The sale comes amid China's sluggish consumer spending and a downturn in commercial real estate, with Beijing's city-wide vacancies reaching 20.6% in the second quarter, the highest in at least 15 years. Parkview Group is involved in various real estate developments across Asia and Europe, focusing on innovative and green designs.

A syndicate of lenders extended the maturity of a loan secured over Parkview Green by a year to August 2025, initially signed in 2019 with an offshore $774 million piece and an onshore 1.2 billion yuan ($165 million) tranche. Existing lenders also agreed to lower the interest rate and convert part of the facility into renminbi from US dollars to reduce borrowing costs.