B

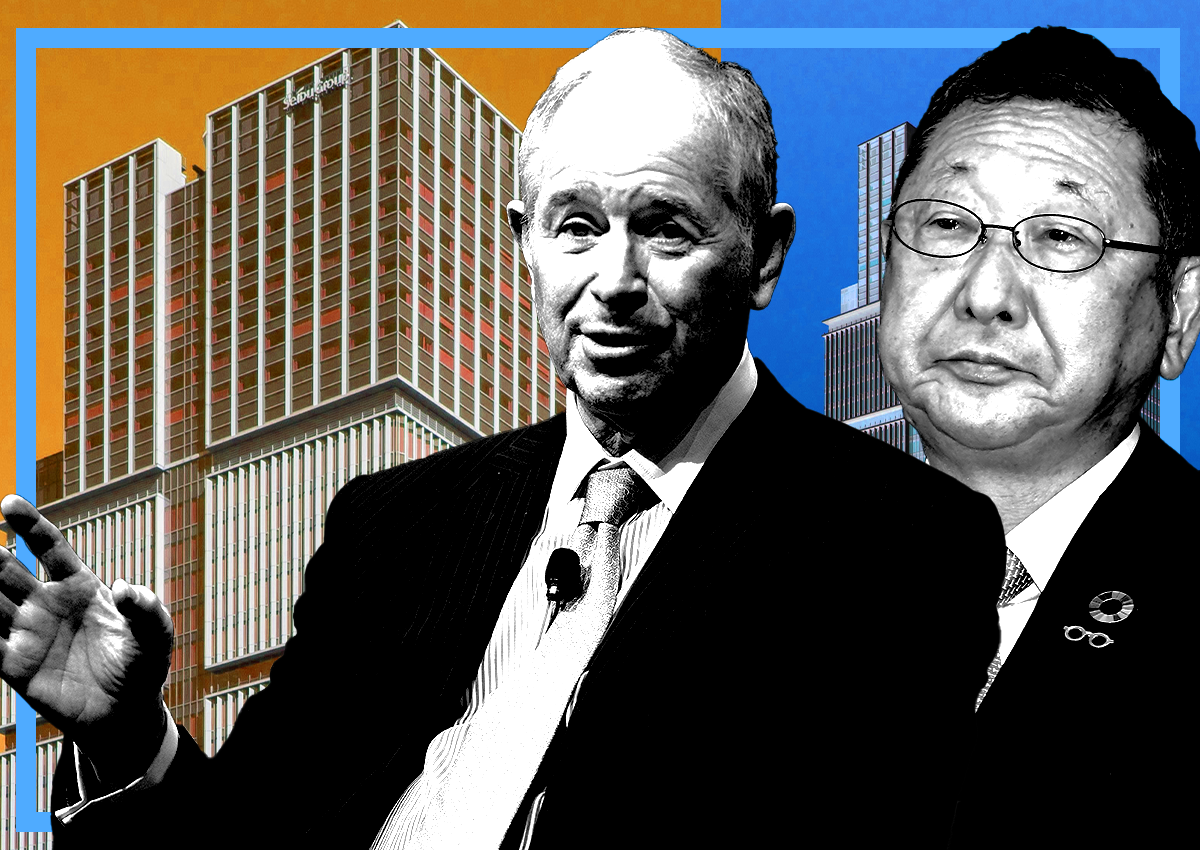

lackstone is making a significant investment in Tokyo's property market with its $2.6 billion acquisition of Tokyo Garden Terrace Kioicho, the largest real estate deal by a foreign entity in Japan's history. The complex spans 2.4 million square feet and includes office space, luxury residences, a hotel, conference venues, restaurants, and retail shops. Seibu Holdings sold the property to capture unrealized profits, with plans to use proceeds from the sale for new investments.

The deal marks Blackstone's largest investment in Japan, following its previous acquisition of a portfolio of hotels, rentals, logistics facilities, and data centers. The private equity firm has been expanding its presence in the country, with total acquisitions reaching $5.2 billion in 2020. Japan's Ministry of Foreign Affairs aims to attract over $6 trillion in foreign investment by 2030, with commercial real estate investments totaling $25.7 billion in the first nine months of this year.

Blackstone's move into Tokyo's property market is driven by factors such as Japan's cheap currency and low borrowing costs, making it an attractive destination for investors. The deal demonstrates Blackstone's confidence in Japan's real estate market and its potential for growth.