B

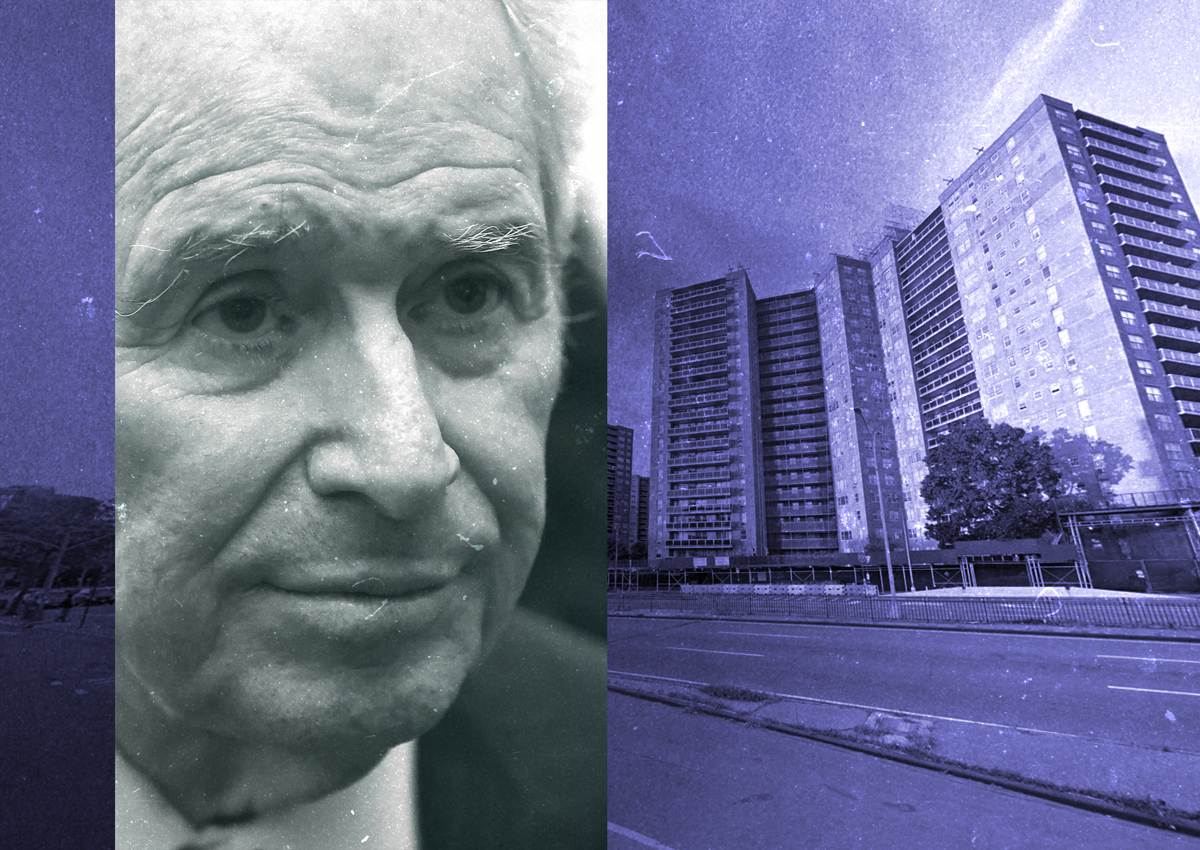

lackstone has agreed to pay nearly $15 million in one of the largest settlements related to rent-stabilization overcharges in New York's history. The private equity firm will compensate tenants at Parker Towers in Forest Hills, with some receiving more than $100,000. Blackstone acquired the 1,300-unit complex for $500 million in 2018 and became the primary defendant in a class-action lawsuit filed by residents.

The litigation stemmed from allegations that rent increases exceeded limits set by the Rent Guidelines Board, despite Jack Parker Corporation's participation in the city's J-51 program, which requires units to remain rent-stabilized. An investigation by Aaron Carr's Housing Rights Initiative found evidence of overcharging, prompting the suit.

Blackstone attempted to settle shortly after its acquisition but was unsuccessful, leading to prolonged litigation. In 2019, it agreed to pay $1 million to current tenants who were allegedly overcharged. The latest settlement involves both past and present tenants and was approved by a judge in September. Blackstone acknowledged past overcharges without admitting wrongdoing.

This is not the first time Blackstone has been involved in rent-stabilization controversies in New York, including its failed attempt to lift rent stabilization ordinances at Manhattan's Stuyvesant Town-Peter Cooper Village complex.