B

oston's Suburban Office Market: A Tale of Two Eras

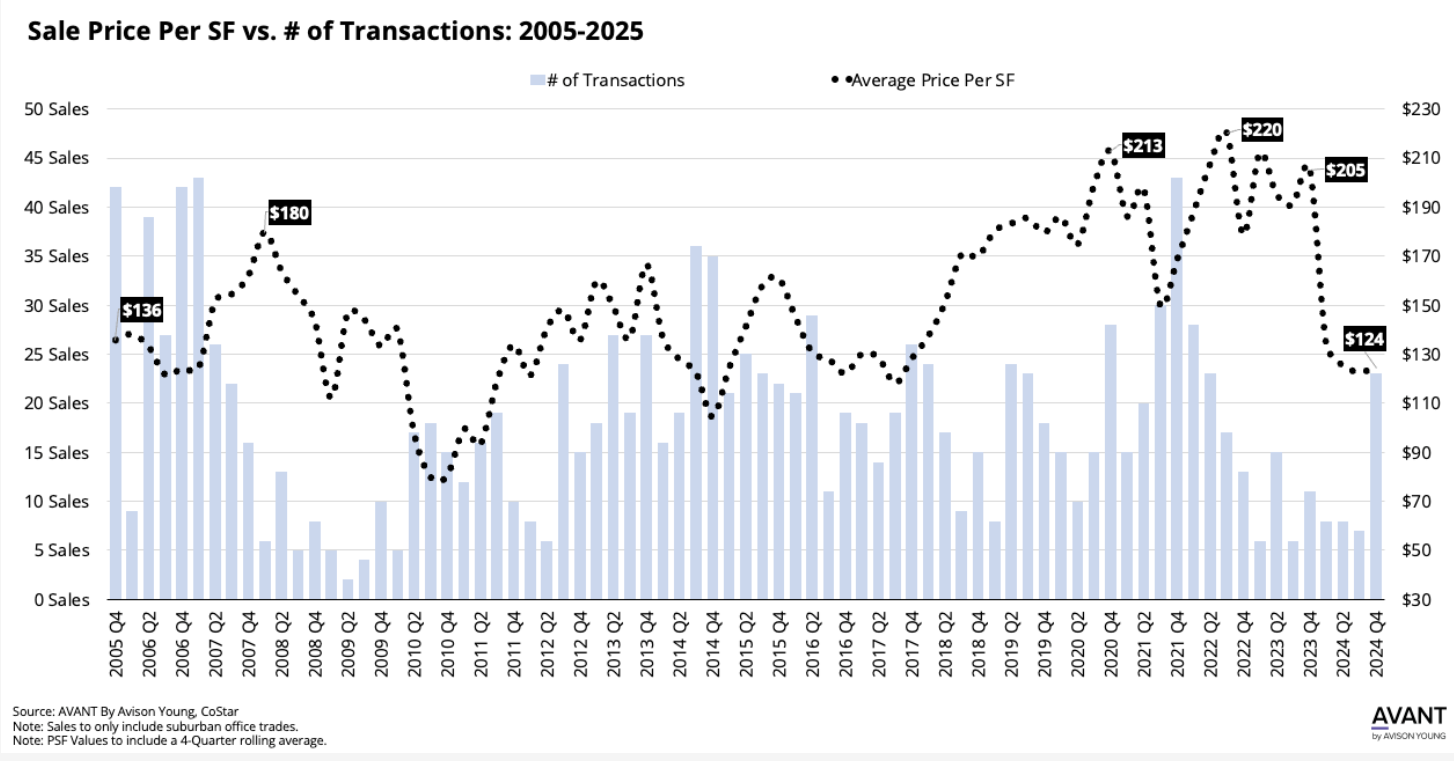

Avison Young's latest Data Bite report reveals a striking contrast between the present and past state of Greater Boston's suburban office market. The average price per square foot (PSF) in Q4 2024 stands at $124, a far cry from the $136 recorded nearly two decades ago in Q4 2005.

The post-COVID lab boom, which peaked between 2020 and 2023, artificially inflated PSF averages to record highs. Office properties slated for life science conversions further fueled this surge, creating an unsustainable bubble. As the market corrects itself, new owners are reassessing their recent purchases with tempered expectations, underwriting them at reduced rental rates to reflect shifting market dynamics.

Recent transactions, such as 199 & 201 Riverneck Rd in Chelmsford and 200 Innerbelt Rd in Somerville, demonstrate this trend. These properties traded at over 40% discounts from their previous sale values, underscoring the significant drop in building pricing. In response, investors have adopted a more aggressive approach to new acquisitions, seeking opportunities amidst the market's correction phase.