C

hicago commercial real estate experts are bracing for a potentially volatile second half of 2025, with concerns about inflation, stagflation, and uncertainty dominating the landscape. A survey by the Real Estate Center at DePaul University and the Urban Land Institute found that over 60% of respondents are in a "wait and see" mode, neither bullish nor bearish on the market's prospects.

The report highlights several key themes, including the impact of tariffs on business transactions, the economy's performance, and the transformative potential of megaprojects. While there is optimism about multifamily and data centers, concerns about global trade, geopolitics, and local financial issues are weighing on sentiment.

Tariffs are seen as a major macro risk to real estate and the economy, with over 80% of respondents believing they have at least a moderate impact on business transactions. Experts warn that tariffs can create uncertainty and shock value, making some projects more difficult to finance.

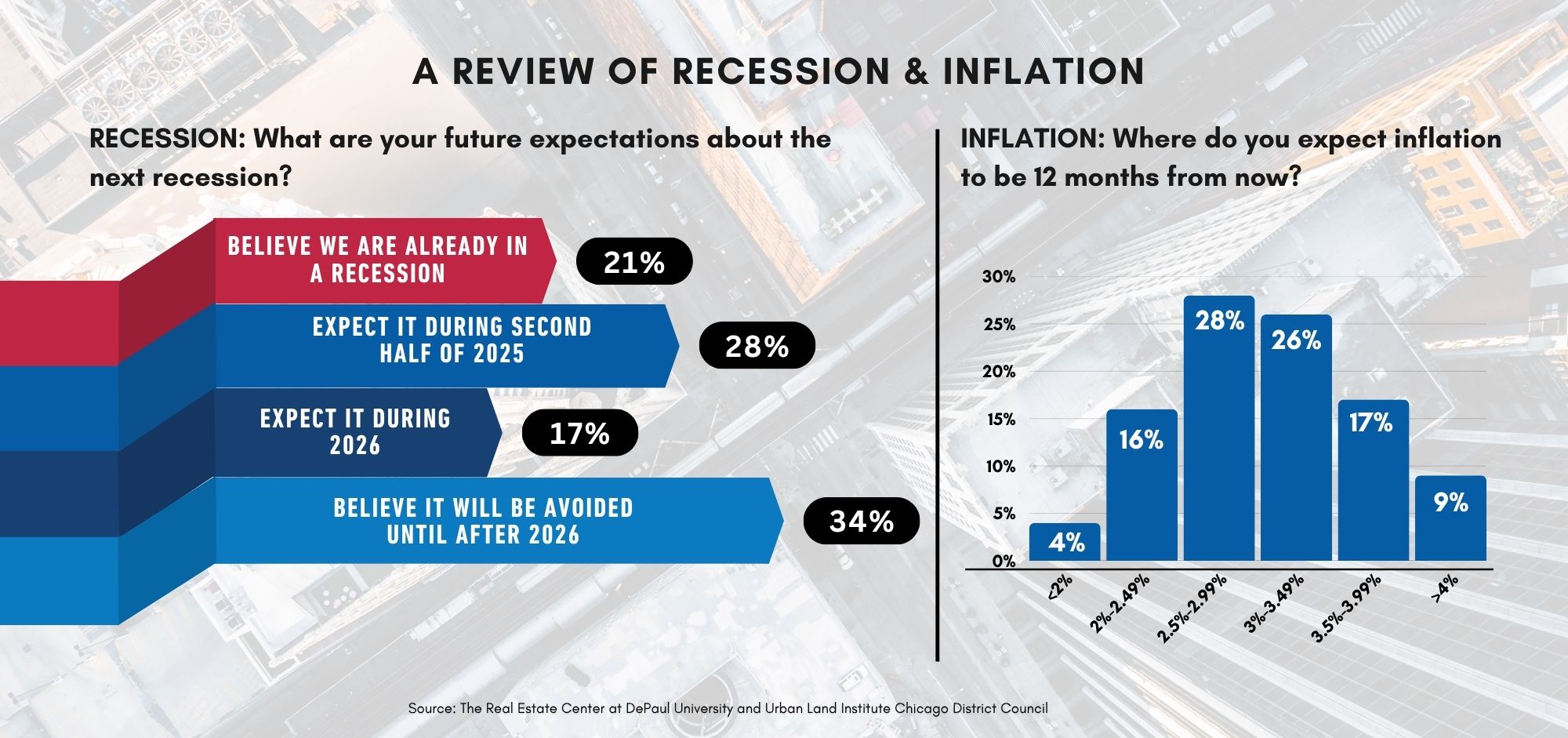

The survey also found that two-thirds of respondents expect a recession before the end of 2026, while half think inflation will be higher than 3%. However, Dr. Jim Shilling believes the US economy should avoid a recession in 2025 due to its momentum and slow-turning nature.

Chicago's real estate community is concerned about local financial issues, with property taxes, pension liabilities, and the city budget ranking as the top three long-term challenges facing the city. Despite this, there are opportunities for investment, with over 70% of respondents saying that debt pricing allows for positive leverage.

The report highlights several megaprojects that have the potential to transform Chicago, including reimagining the Loop and expanding the United Center Campus. These projects are driven by passion and a desire to create something beautiful and transformative for the city.

Government policies are viewed with skepticism, with Springfield policies being seen as the most positive. However, experts note that uncertainty and chaos can create opportunities for investors to take advantage of dislocations.