A

swath Damodaran's annual update on long-term returns for various asset classes is out, and it's a treasure trove of data. The NYU professor has been tracking returns for stocks (S&P 500), bonds (10-year Treasuries), cash (3-month T-bills), real estate, gold, and inflation since 1928, with this year's update adding small caps to the mix.

Here are the long-term returns for each asset class from 1928-2024:

* Stocks: +9.94%

* Small caps: +11.74%

* Bonds: +4.50%

* Cash: +3.31%

* Real estate: +4.23%

* Gold: +5.12%

Inflation has averaged around 3% per year over the past 97 years.

Looking at annual returns by decade, it's striking how few "lost decades" there are in the data. The small cap data is particularly interesting, but requires some context. From 1940-1969, small caps outperformed large caps significantly, but this was largely due to tiny micro caps that were illiquid and expensive to trade.

Since 1970, small caps have performed more similarly to large caps, with annual returns around 10%. This highlights the importance of diversification, as seen in decades like the 2000s and 1970s when large caps struggled and small caps picked up the slack. Conversely, large caps have returned the favor in recent years.

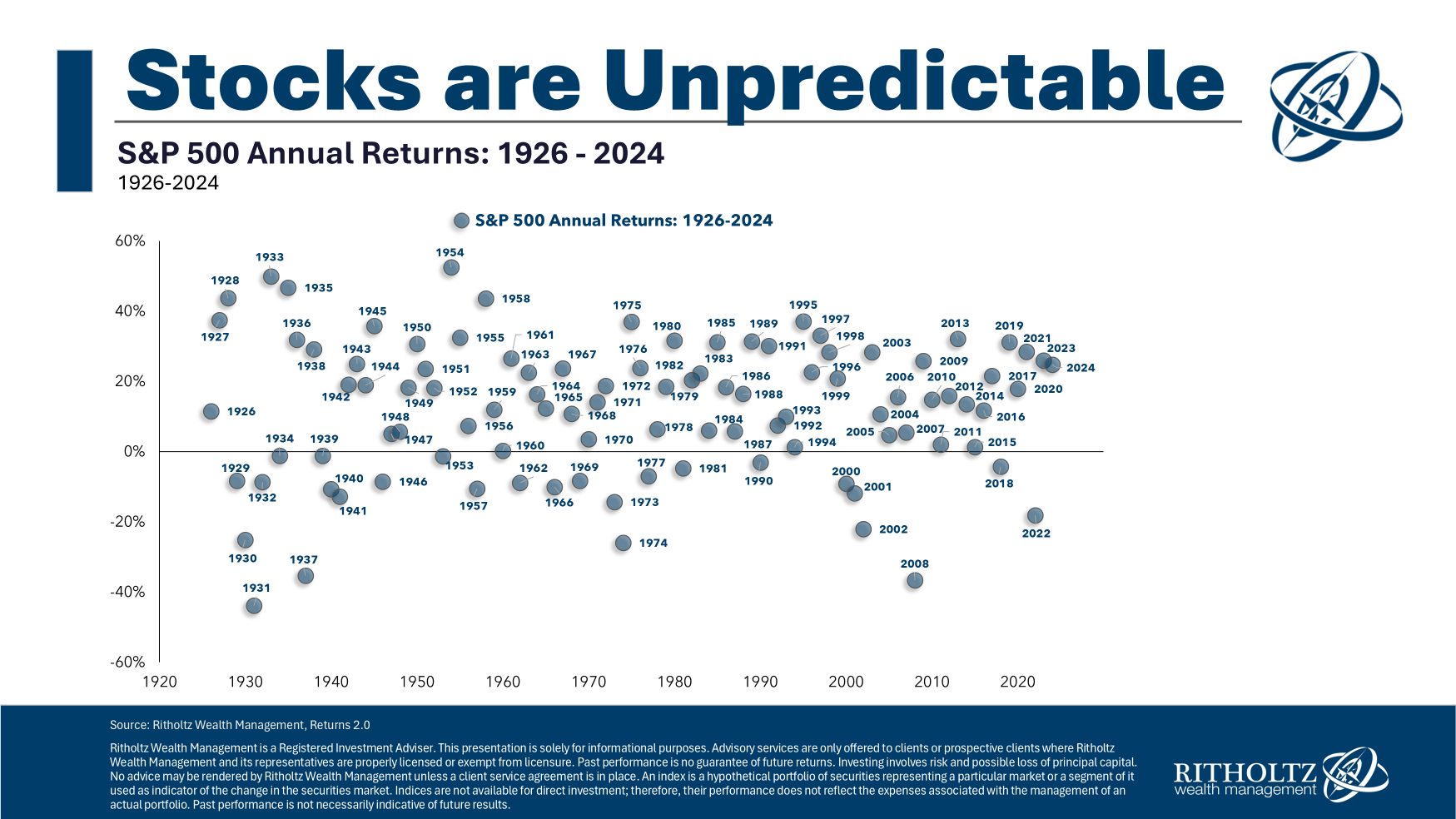

The takeaway from this dataset is that diversification is key, and there are no constants from one period to the next. Markets are unpredictable, and performance numbers can be all over the map. Even in recent years, returns have been relatively similar, but this is not the norm.