A

New York-based real estate developer, Elchonon "Elie" Schwartz, has been sentenced to 87 months in federal prison for defrauding over 800 investors out of $62.8 million through a fake commercial real estate scheme. The scheme involved using investor funds for personal luxury purchases and risky investments instead of the promised projects.

Schwartz, former CEO of Nightingale Properties, pleaded guilty to wire fraud in February and was ordered to pay over $45 million in restitution. He raised tens of millions of dollars through the real estate crowdfunding platform CrowdStreet by promoting two fictitious projects: a $54 million acquisition of the Atlanta Financial Center and an $8.8 million recapitalization of a Miami Beach development.

Investors were assured their funds would be kept separate, but nearly all money was funneled into Schwartz's personal accounts. He used investor cash to fund luxury purchases, including a $120,000 watch, and payroll expenses at other failing properties. The projects never closed, and Nightingale subsidiaries filed for bankruptcy in 2023.

A trustee has been working to recover the funds, but less than 20% has been returned so far. Victims are critical of the sentence, saying it doesn't match the damage inflicted by Schwartz. His legal team had sought probation, citing financial strain and pressure from the post-pandemic real estate downturn.

Schwartz claimed remorse in a court letter, stating he acted out of desperation. He has aligned with the Aleph Institute, a nonprofit supporting incarcerated individuals within the Jewish community. However, efforts to compensate victims have been hindered by Schwartz's reluctance to liquidate assets, including his $18 million Manhattan penthouse. The bankruptcy trustee has sued for eviction after Schwartz defaulted on a repayment agreement.

The Securities and Exchange Commission (SEC) has filed a separate civil suit accusing Schwartz of securities fraud tied to a $6.4 million stock purchase. Investors are frustrated by the delay in recovering their losses, with one saying, "This wasn't a deal gone bad – it was outright fraud."

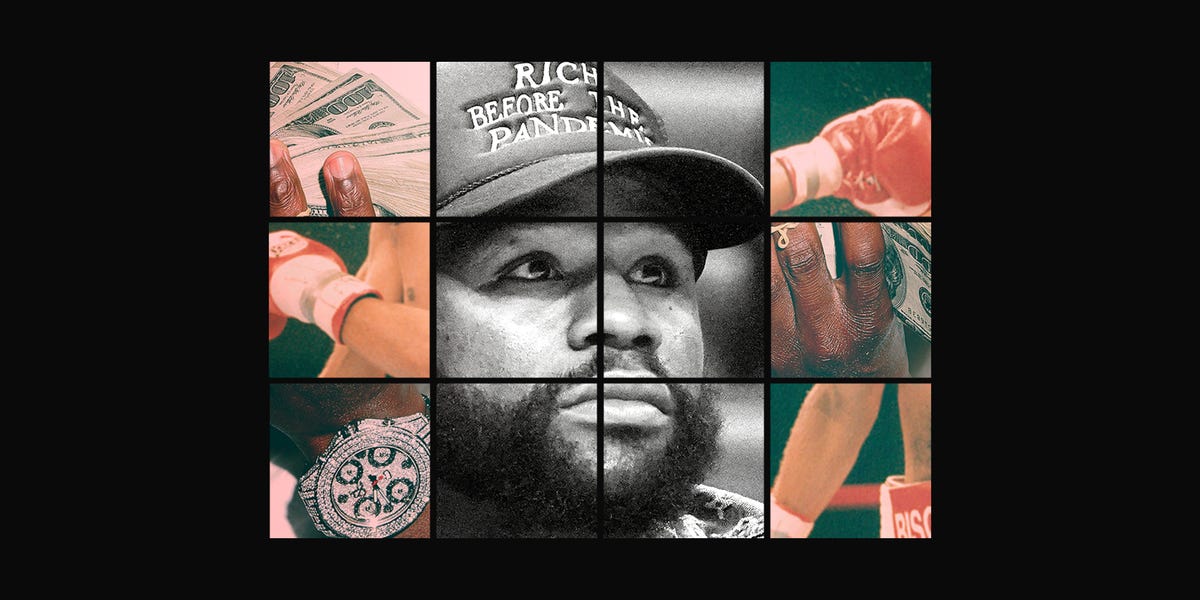

![Developer sentenced to 7 years for $62.8m commercial real estate scam in [location].](https://static.realestate.news/2025/5/22/21299/0321_638835219560907864.png)