U

S commercial real estate investing has traditionally favored core property sectors, but recent market forces and new leadership may disrupt this approach. The four core property types - office, industrial, retail, and apartment - provided consistent income and value appreciation, but alternative property sectors are gaining traction.

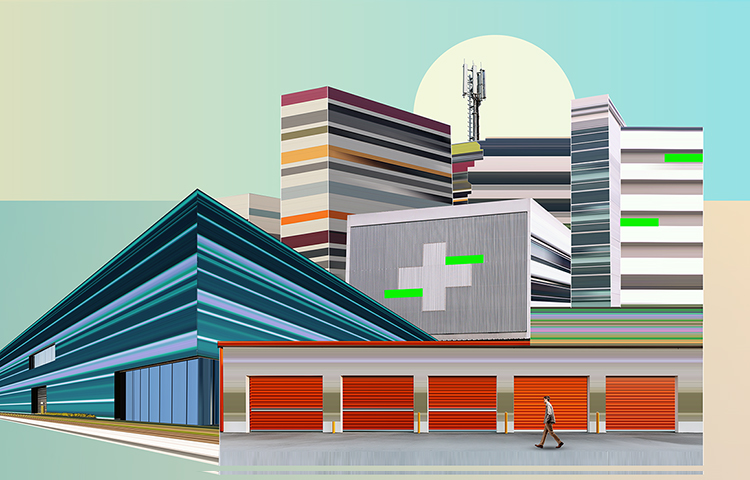

Alternative property types, such as data centers, cell towers, life sciences laboratories, and self-storage facilities, have grown at a 10% compound annual growth rate (CAGR) to over $600 billion in 2024. They have outperformed traditional properties with 11.6% annualized returns compared to 6.2% for core property types.

Public real estate investment trusts (REITs) have led the adoption of alternatives, increasing their allocations from 26% in 2000 to over 50% in 2024. Private funds are also shifting towards alternative asset classes, with some acquiring existing REITs and their underlying assets.

Advances in technology, demographic shifts, and housing affordability may make alternatives a long-term durable asset class. The next generation of leaders is expected to favor alternative property types more frequently than their predecessors, potentially accelerating the shift.

However, reallocation from core properties to alternatives will likely take time due to elevated interest rates and economic uncertainties. As conditions improve, opportunities for portfolio realignment may arise. Key subsectors within alternatives, such as digital economy and health care sectors, are expected to drive growth.

Navigating this shift requires active management, experienced partnerships, and a focus on regional supply and demand gaps. Investors should balance alternative properties with core assets to mitigate volatility risks. The next generation of leaders will need to collaborate to bring alternative property types into the mainstream.

By 2034, alternatives could account for nearly 70% of industry portfolio values, surpassing core assets for the first time. However, this growth may accelerate if next-generation leaders favor alternative assets over legacy core strategies.