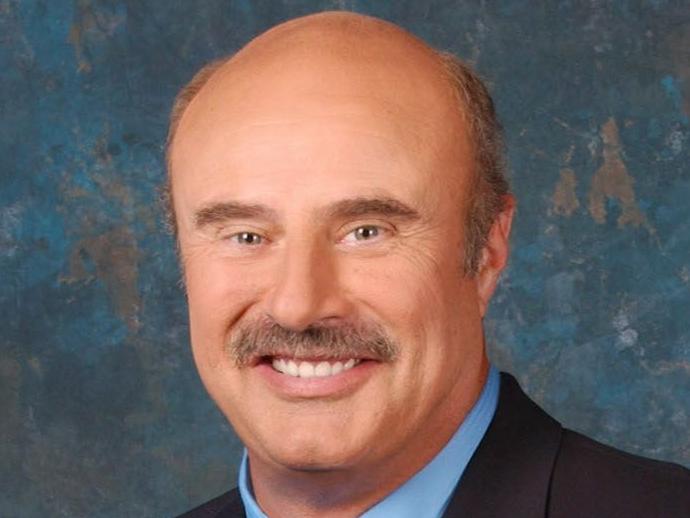

D

r Phil’s personal fortune is estimated at $460 million (AUD 704 million), a large portion of which is tied up in real‑estate holdings. The television icon owns three major residences: a sprawling Dallas mansion on 1.64 acres that spans 14,719 sq ft, a six‑bedroom, 8.5‑bath Calabasas, California home acquired in 2011 for $6.58 million, and a Beverly Hills property purchased in 2020 for $10 million. The Dallas estate, bought for $13.9 million in 2022, now exceeds $14 million in value; the Calabasas house is valued at roughly $11.4 million, while the Beverly Hills home is estimated near $13.6 million. All three properties are held within a family trust.

In July, Dr Phil filed for Chapter 11 protection for his media venture, Merit Street Media, hoping to restructure the company. U.S. Bankruptcy Judge Scott Everett rejected the petition, citing incomplete financial disclosures and deleted text messages that suggested preferential treatment of certain creditors. The judge deemed Merit Street already insolvent at the time of filing and ordered a Chapter 7 liquidation, appointing a trustee to sell the company’s assets to satisfy creditors.

Merit Street had previously reported assets between $100 million and $500 million. The firm is embroiled in a legal battle with Trinity Broadcasting Network (TBN), which had secured a $500 million distribution deal. Merit Street sued TBN for breach of contract, accusing the network of exploiting its controlling stake; TBN countersued, alleging fraud against Dr Phil. Amid these disputes, Dr Phil launched a new venture, Envoy Media, just one day before the bankruptcy filing—a move the judge suggested was an attempt to secure funding for the new company.

Peteski Productions, Dr Phil’s production arm, has denied the court’s claims of evidence tampering, asserting that no texts were destroyed and that the company has acted in good faith to protect employees, distributors, and other stakeholders.

Despite his substantial net worth, Dr Phil’s attempt to shield Merit Street from creditors has failed. The court’s decision to shift the case to liquidation underscores the seriousness of the company’s financial distress and the judge’s belief that no viable rehabilitation plan exists.