T

his week at the Calculated Risk Real Estate Newsletter:

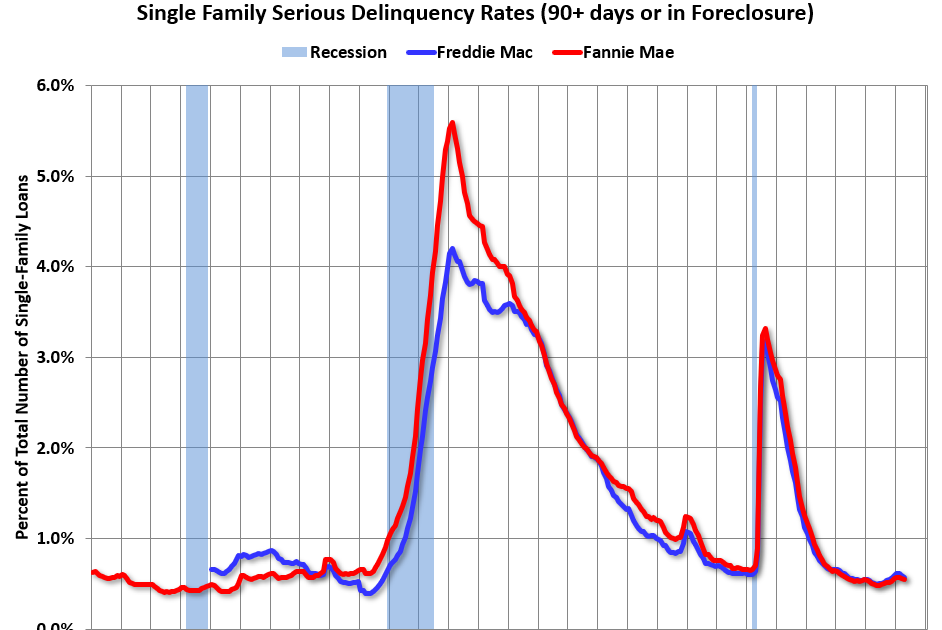

• Fannie and Freddie's single-family serious delinquency rates dropped in April, a positive sign for the housing market.

• The Q1 update reveals trends in delinquencies, foreclosures, and REO properties.

• A closer look at local housing markets shows changes in May.

• The June ICE Mortgage Monitor reports that home prices are continuing to slow down.

• Asking rents remain largely unchanged year-over-year.

This newsletter typically publishes 4-6 times a week, offering more detailed analysis of the housing market.