F

our weeks ago, The Real Deal reported that mortgage rates had hit their lowest levels in 19 months. Since then, rates have steadily increased, with the average 30-year fixed-rate mortgage rising from 6.11 percent on September 11 to 7.13 percent by November 6, following Donald Trump's presidential election victory. Mortgage Bankers Association chief economist Mike Fratantoni attributed the rate hike to investors' expectations of stronger economic growth, higher inflation, and larger deficits.

Mortgage applications have declined for six consecutive weeks, largely due to rising rates. However, this trend was already underway before the election, suggesting that other factors were at play. The Federal Reserve's decision to reduce the federal funds rate by 25 basis points on Wednesday added to the mix of economic data influencing investor behavior.

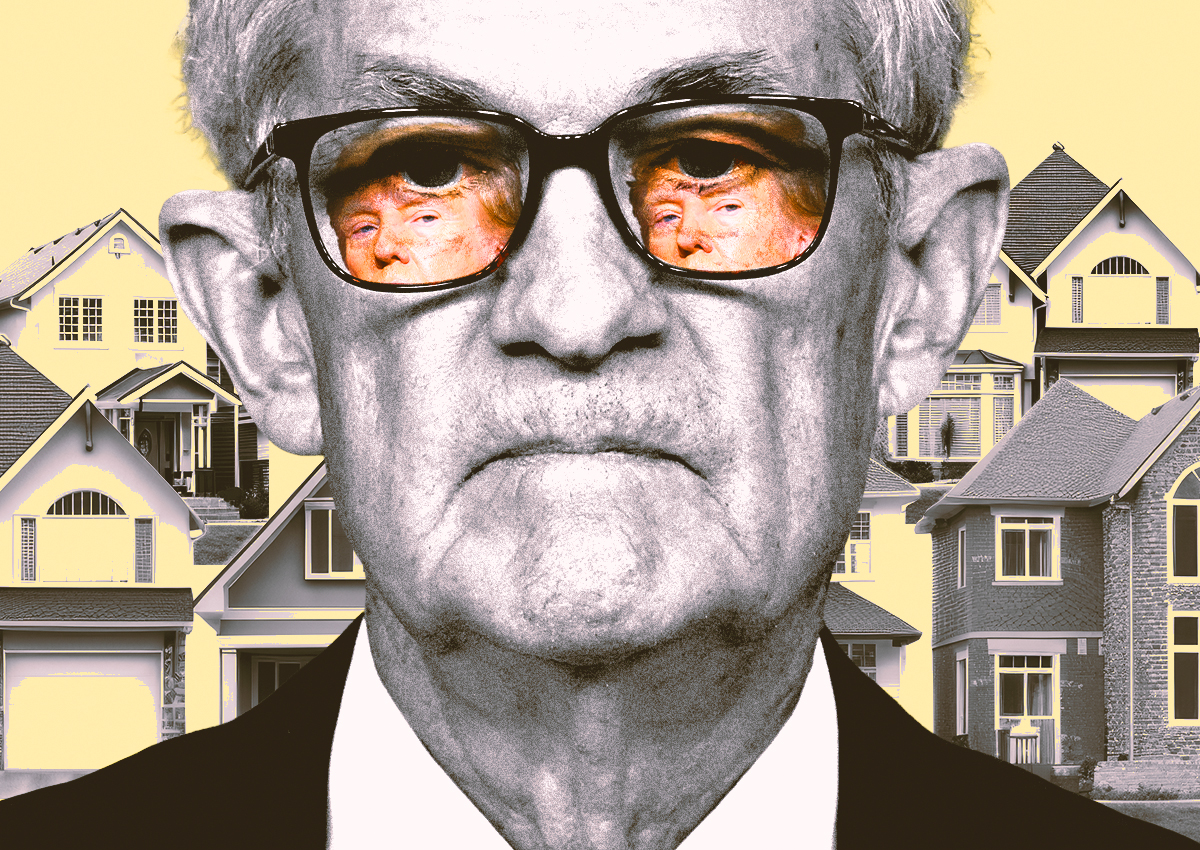

Fed Chair Jerome Powell's comments after the Fed's statement offered little insight into future rate cuts, saying "We don't guess, we don't speculate, and we don't assume." The outcome for mortgage rates will likely depend on the economy's performance under Trump's administration. If the economy grows or if Trump implements stimulus measures, rates are expected to rise.

For real estate agents and mortgage brokers, this means that rates on 10-year Treasuries and mortgages will increase with economic growth or government spending. The housing market is already experiencing a slow recovery, with homeowners hesitant to give up low-interest mortgages for the sake of moving. Mortgage applications for purchases have only increased by 2 percent over the past year.

The Mortgage Bankers Association predicts that mortgage rates will remain within a narrow range over the next year, increasing on signs of economic strength and decreasing otherwise. However, their previous predictions about falling rates have not come to pass. Despite this, Fratantoni remains optimistic, citing potential for a stronger spring homebuying season due to increased housing supply and slower price growth.