T

he state House killed a bill targeting big investors in residential real estate, but the issue remains. Senate Bill 1033 aimed to tax hedge funds and other large institutional investors buying up local homes, with a steep excise tax on newly acquired properties and penalties for exceeding a set number of holdings.

However, Housing Committee Chair Luke Evslin declined to hear the bill, citing concerns from the Department of Taxation that it would be difficult to implement. He also argued that there's no evidence showing these entities own a significant share of homes in Hawaiʻi, and that the real problem is underproduction, not over-speculation.

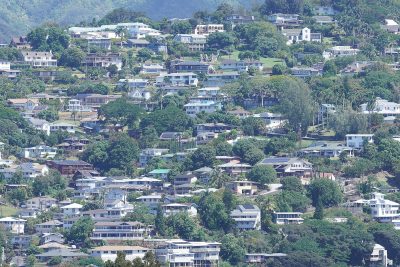

Most economists and housing advocates agree that Hawaiʻi hasn't built enough homes due to infrastructure costs, restrictive zoning, and lengthy permitting delays. Governor Josh Green's emergency proclamation on housing aimed to cut through this red tape, but it was short-lived and controversial.

The truth is, we've made it difficult to build in this state because we value the land for more than just housing. We haven't figured out how to balance cultural and environmental values with the need to shelter our communities, which is a major part of the problem.

Despite the lack of conclusive data, there's growing anxiety about institutional investors consolidating residential properties in strained markets. The perception that local families are being priced out by cash offers from out-of-state buyers has power, especially in Hawaiʻi where generational families compete with these buyers.

Sen. Chris Lee, who introduced SB 1033, said the next step is to gather better data on the residential real estate market and understand who's buying up local homes and what it means for the market. This is a good step, as we're trying to address a problem without fully understanding its scope.

In the meantime, there are other ways to rethink our tax structure without driving away investors. Hawaiʻi has the lowest effective property tax rate in the nation, which increases demand on our limited supply and hasn't done much to distinguish between homes for local families and those that sit empty.

Rep. Luke Evslin supports taxing vacant properties at a higher rate, an idea that could help reduce speculation while avoiding ownership-based taxation. He argues that if the goal is to bring prices down, we should care about how a property is used, not who owns it.

Currently, property taxes are within counties' control, but some lawmakers have suggested withholding state funding to push counties to reform their property tax systems. House Finance Chair Kyle Yamashita floated this idea last year.

For locals, the issue is personal – they want to believe that if they work hard and save, they'll be able to live near their parents, raise their kids, and age in place. Hawaiʻi's housing crisis isn't just about economics; it's about fairness and the promise of a better life.

The real problem is that we keep circling the same debates without deciding what kind of housing market we want and who we want it to serve. Until we do that, no tax policy, permit reform, or zoning change will solve the deeper issue.