T

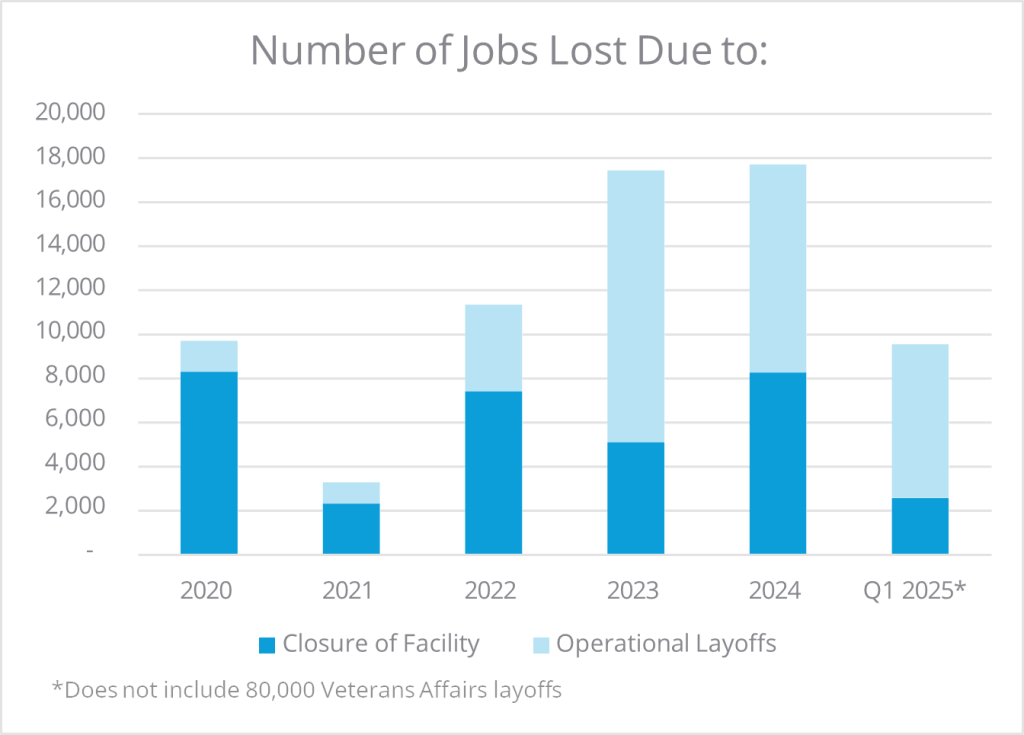

he COVID-19 pandemic has left the healthcare industry facing significant financial constraints, exacerbated by inflation and the expiration of $185 billion in Provider Relief Funds. This has led to a surge in operational restructuring layoffs, with 12,000 such layoffs in 2023 and 9,500 in 2024. In Q1 2025, operational layoffs increased to 67% of 2024's total, signaling a continuation or worsening of the trend.

Examples of these restructuring measures include:

* Fairview Health Services eliminating 250 jobs through layoffs and attrition due to financial pressures.

* UNC Health laying off around 40 leadership-level roles to move towards a sustainable leadership structure.

* Cleveland Clinic reducing 114 positions in January 2025 to drive operational efficiencies.

These layoffs are predominantly affecting non-patient-facing roles such as marketing, IT, and finance. Real estate professionals within healthcare systems may present an opportunity for systems to turn financial constraints into revenue sources.

The expiration of Provider Relief Funds has left many organizations struggling with post-pandemic economic realities, including rising labor costs, inflation, declining reimbursement rates from insurers, and uncompensated care. Mergers and acquisitions have also contributed to layoffs by creating redundancies within newly merged organizations.

Healthcare systems can manage financial constraints and operational challenges by outsourcing transactional real estate roles to a third party. This model has been successfully implemented by several healthcare providers, offering benefits such as cost efficiency, value-added resources, market expertise, redundancy and scalability, and peer benchmarking.

For example, a large healthcare system in the Upper Midwest hired Colliers as an outsourced real estate partner, saving approximately $200,000/year in direct personnel expense while increasing revenue derived from real estate transactions to $400,000/year. This model allows healthcare providers to reallocate FTEs from their balance sheets onto a vendor contract, maintaining strategic control and operational efficiency.

If your organization is considering workforce reductions, Colliers can help determine if an outsourced real estate model is suitable for your needs.