S

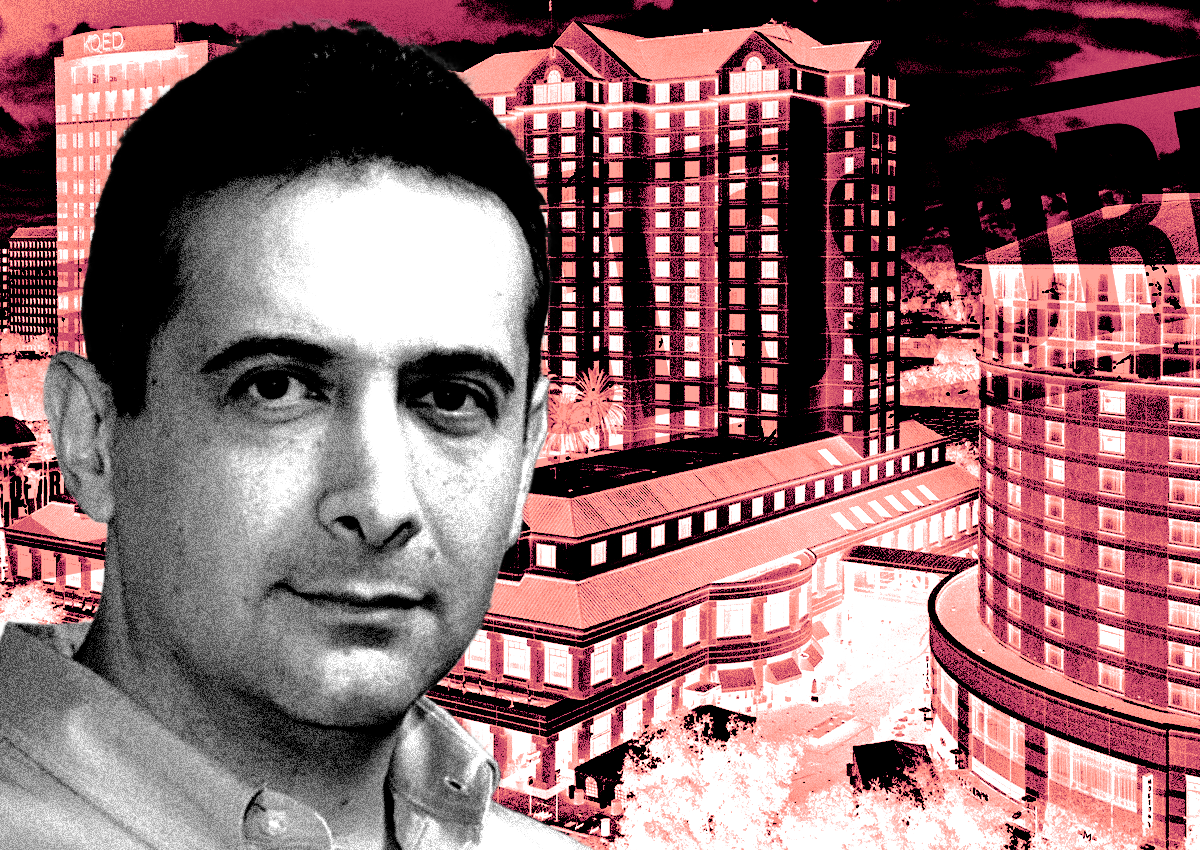

am Hirbod, owner of the Signia by Hilton San Jose hotel, claims he has secured a new financing deal with undisclosed lenders to prevent foreclosure. According to Hirbod, his company Eagle Canyon Capital has a deal in place to refinance the delinquent loan tied to the 541-room hotel at 170 South Market Street. The loan was originally taken out by BrightSpire Capital for $185 million.

Hirbod's ownership group purchased the former Fairmont San Jose in 2018 for $223.5 million and invested an additional $75 million in upgrades. However, the hotel fell into bankruptcy in 2020 due to pandemic-related business shutdowns and travel restrictions. It reopened in 2022 after Eagle Canyon sold a portion of the property to Throckmorton Partners.

BrightSpire has filed a notice of default and scheduled an auction for the hotel as early as next month, which could trigger foreclosure. Hirbod initially thought he had secured fresh capital with a new lender but ultimately walked away from the deal due to unfavorable terms. He now claims that four top-notch lenders are willing to provide financing at better terms, with Hilton agreeing to support these efforts.

Hirbod is confident that the hotel's occupancy rates and operating profits will prevent foreclosure. "We have four lenders that are looking to provide the financing and at better terms," he said. "Hilton has agreed to step up and support these efforts." If necessary, Hirbod plans to file for Chapter 11 bankruptcy protection to reorganize the hotel's finances and avoid a forced sale.